|

|

Cash Flow Management |

Cash flow forecasting |

|

The technique of cash flow forecasting simply means working out the effect of the flow of cash on the cash balance of the business.

|

|

|

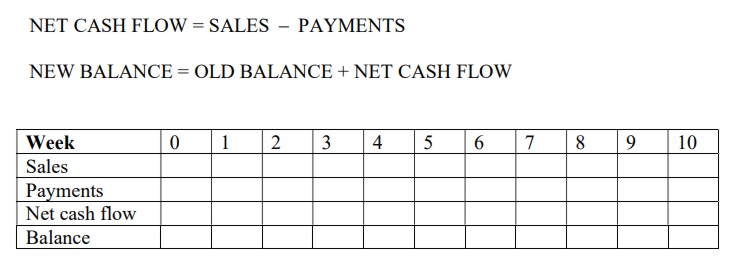

The net cash flow arises from subtracting the payments the company makes during a given period from its receipts. There is a positive cash flow if payments are less than receipts, and a negative cash flow if payments are greater than receipts. A negative cash flow can be represented either by a minus (−) sign, or by putting the figure in brackets.

|

|

|

The net cash flow is added to the previous balance to find the new balance. If the cash flow is negative, then, obviously, we subtract the figure.

|

|

|

This is best understood by working through an example.

|

|

Example — Jonathan's Idea |

|

The small business advisor of National Bank in Polisville has been approached by Jonathan for an overdraft. Jonathan wishes to establish a carpet cleaning service under a national frachise. He needs a van and equipment, and for this purpose he has been granted a loan by the franchise of £30,000 at 3.25% interest per annum. The interest will be calculated upon an annual basis but will be paid weekly. The capital is also to be repaid in equal weekly installments over two years.

|

|

|

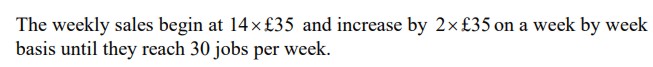

Jonathan believes that his running costs will amount to £200 each week and he intends to draw £275 each week for his own living expenses. He also believes that he can achieve sales of 14 cleanings in the first week at an average price of £35, and this will rise by 2 jobs per week until he reaches his capacity at 30 jobs per week.

|

|

|

Jonathan has £600 of his own money. All cash will be banked.

|

|

|

Assuming a 50 week year prepare Jonathan's projected cash flow for the first ten weeks and his bank balance at the end of each week.

|

|

|

What further points might National Bank consider before granting Jonathan an overdraft.

|

|

|

If you were in this situation would you do what Jonathan is doing? Also, would you, as the small business adviser, grant Jonathan the overdraft?

|

|

|

To help you solve this problem and understand the idea of cash-flow forecasting, I will provide a series of hints, followed by the solution

|

|

|

Hint 1

|

|

|

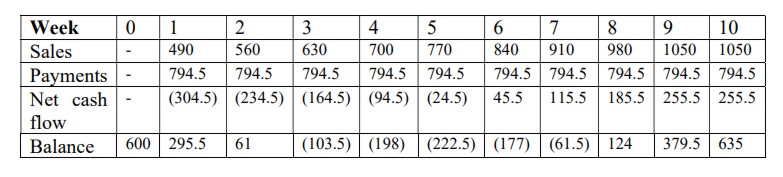

We forecast cash flow by calculating the weekly net cash flow. We estimate the sales, we estimate the payments and we find the net cash flow as sales less payments. The new cash balance at the end of the week is sum of the old cash balance and the net cash flow

|

|

|

|

|

The first practical problem here is to calculate the weekly sales, and the payments.

|

|

|

|

|

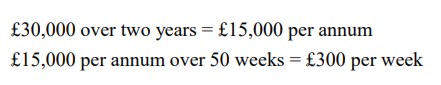

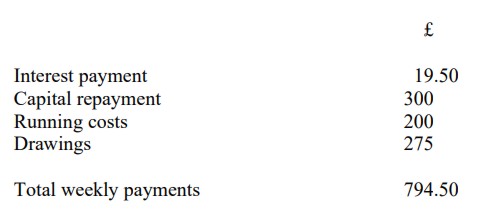

The payments arise from interest payments on the loan, repayments of the loan, running costs and drawings. You need to calculate all of these. The total weekly payments do not vary.

|

|

|

Hint 2

|

|

|

Here we show the calculations hinted at in the previous hint! Interest repayments on the loan granted by the franchise is:

|

|

|

|

|

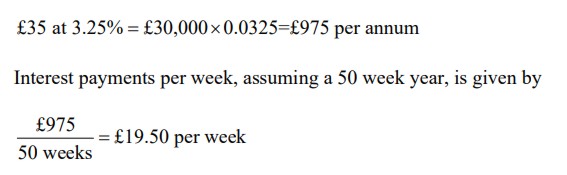

Jonathan does not only have to pay the interest, he also has to pay back the loan. The calculation of the capital repayment is as follows.

|

|

|

Capital repayment over two years:

|

|

|

|

|

Finally, the payments each week are

|

|

|

|

|

Solution

|

|

|

We can now complete the cash flow forecast

|

|

|

|

The Distinction between Cash Flow and Profit |

|

Cash flow is not the same as profit, which is a very important point that will be investigated in further units.

|

|

|

Profit is given by all sales less all costs.

|

|

|

A positive cash flow is an increasing quantity of cash in, for example, your cash box, or your bank account.

|

|

|

The need to distinguish between the two arises because a company can be profitable and yet experience a temporary negative cash flow. For example, when the company is expanding and buying lots of new equipment it will need lots of cash to pay for it all. The company could be basically profitable, but experiencing a substantial outflow of cash. So, in this case the company's cash is running down even though it is profitable.

|

|

|

It can also work in reverse. A company could be receiving a lot of cash from investors − for example, shareholders paying for their shares. But the company could be basically unprofitable and trading at a loss, and whilst the cash is increasing the long-term viability of the company is in serious doubt.

|

|

|

Companies go out of business for one of two reasons: (a) they are unprofitable; (b) they run out of cash.

|

|

|

It is extremely frustrating for a profitable business to go out of business because it runs out of cash, and the first step to avoiding this disaster is knowing how much cash is flowing in on a month by month, week by week or day by day basis.

|

|