|

Costs, Profit, Contribution and Break-even Analysis |

Capital Expenditure and Costs |

|

Business is conducted by exchanging liquid assets for fixed assets and vice-versa.

|

|

|

A first type of payment occurs when we exchange cash or another liquid asset for such things as property, machinery and vehicles. These are material assets that enable us to make things.

|

|

|

A second type of payment occurs when we purchase such things as raw materials, and employ people to operate the machines, answer telephones and the like.

|

|

|

Rent is an example of this second type of payment. We may decide to hire rather than buy a photocopier. The rent on the photocopier must be paid for, and we pay rent for the use of the photocopier.

|

|

|

The first type of payment is called an investment, and the second type of payment is called a cost.

|

|

|

Investments increase the material, that is, fixed assets, of the person buying them. The owner has an item that can be used as a means of production. Investment in such items is called capital expenditure

|

|

|

1. What is the distinction between fixed and liquid assets?

|

|

|

The most liquid asset is cash. A liquid asset can be used to pay a bill. The more liquid an asset the more readily it can be exchanged for cash. Fixed assets are those that take time to be sold. They cannot be exchanged immediately for goods and services. Factories and vans are examples of fixed assets.

|

|

|

2. Why is business conducted by exchanging fixed assets for liquid assets?

|

|

|

Money is in itself unproductive. It does not make anything. So cash (the ultimately liquid asset) must be used to by other assets that can be productive, such as machinery. These fixed assets are used in conjunction with other inputs — labour and raw materials — so make goods and services that can be sold for cash. Hence liquid assets are exchanged for fixed assets, which produce goods and/or services that result in sales, bringing in further liquid assets.

|

|

|

3. Explain how you win a game of Monopoly in terms of the exchanges going on in the game between fixed and liquid assets.

|

|

|

Monopoly introduces children to the basic rules of capitalism. The players all start with an equal amount of cash. They win by making judicious investments — that is, buying property and eventually investing further in this property by developing houses and hotels. A player that does not buy property cannot win. The winning strategy is to maintain the optimum ratio between liquid and non-liquid assets, since it is costly to convert fixed assets into liquid assets to pay rent.

|

|

|

4. What is the distinction between costs and capital expenditure?

|

|

|

A capital item is used to make things — in the sense of providing the facilities for production — a factory, a machine — these are examples of capital items. But the making of goods requires other factor inputs as well — raw materials and labour. Every time a good is produced these are consumed. These inputs are called costs in accounting terms.

|

|

|

5. Does property always appreciate in value?

|

|

|

The value of a property is determined by a market in accordance with supply and demand. If demand increases ahead of supply, then property prices will increase. The price of a property is not determined by any intrinsic (inner) value, such as the cost of the building materials and labour to make it. So, of course, property can go down in value — that is, price. If, for any reason, supply grows more than demand, prices of properties will fall.

|

|

Classification of Costs |

|

Costs are payments incurred in day-to-day production. It is possible to analyse costs in two separate ways.

|

|

|

Classification by type

|

|

|

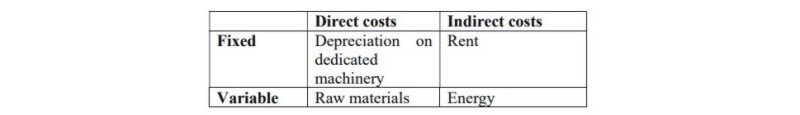

Costs are classified as either arising directly or indirectly.

|

|

|

Direct costs are ones that can be specifically related to the production of a particular good.

|

|

|

Indirect costs are those that are not so specifically related.

|

|

|

For example, suppose a company manufactures chairs. The cost of the labour and raw materials that goes into the manufacture of the chairs are direct costs. The production overheads include the factory rent and heat, light and power, and depreciation on plant and machinery.

|

|

|

Indirect costs are also frequently called overheads.

|

|

|

Classification by behaviour

|

|

|

This is concerned with the way an impact of a change in output causes a change in costs.

|

|

|

Costs are classified in this way as either fixed or variable.

|

|

|

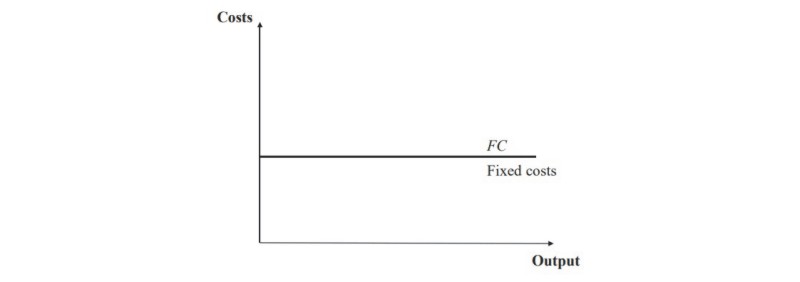

Fixed costs do not change as the quantity of output changes. Increasing output does not increase these costs.

|

|

|

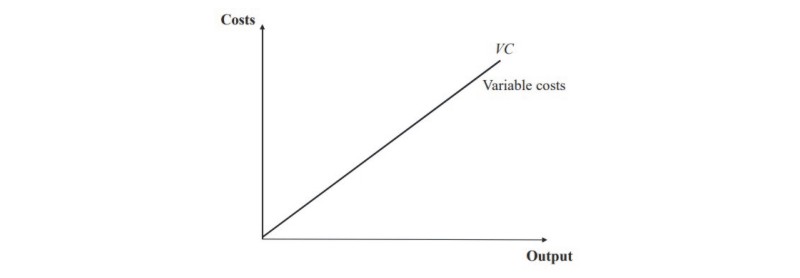

Variable costs do change. Variable costs increase as output increases.

|

|

|

It is a mistake to confuse indirect costs with fixed costs. Both direct and indirect costs can and do vary with output, and both can, and do, contain elements of fixed costs. For example, the amount of energy used by a company (an overhead) does increase with the number of goods produced.

|

|

|

The usual example of a direct cost that is also fixed is depreciation on machinery. Depreciation is the loss of value of an asset owing to ageing. Machinery just wears out, and so loses value. Depreciation on dedicated machinery means depreciation on machinery that is used for only one purpose in the production cycle, and so can be regarded as a direct cost.

|

|

|

|

Fixed and variable costs — Break-even analysis |

|

Economists classify costs as either fixed or variable. At present we are concerned with how costs vary with output in the short run. The short run is defined as a period of time in which at least one factor of production is fixed — usually capital. That is, a firm as a fixed size of plant. In the long run the firm can move to larger or smaller premises.

|

|

|

In the short run, because the capital (and hence size of production unit) is fixed, the fixed costs remain constant. That is, fixed costs are those costs that remain constant regardless of the quantity produced in the short run.

|

|

|

|

|

Fixed costs

|

|

|

An example of a fixed cost would be rent on a building. The rent remains constant regardless of how much business is done in it.

|

|

|

Variable costs are those cost that change as output increases.

|

|

|

|

|

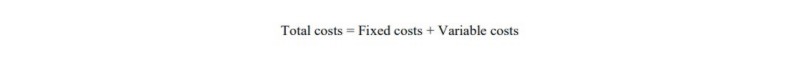

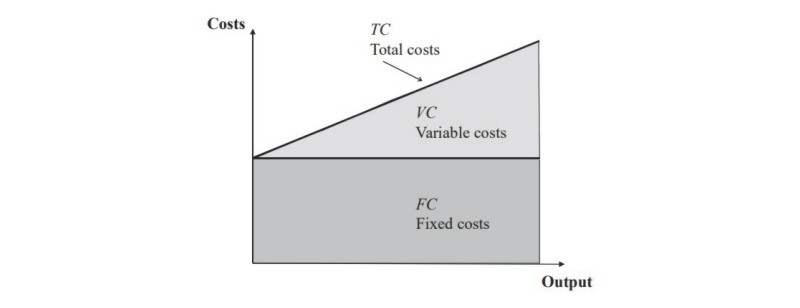

Total costs are the sum of fixed costs and variable costs.

|

|

|

|

|

It is usual to show total costs in a graph as follows:

|

|

|

|

|

The variable costs are added to the fixed costs to show the total costs.

|

|

|

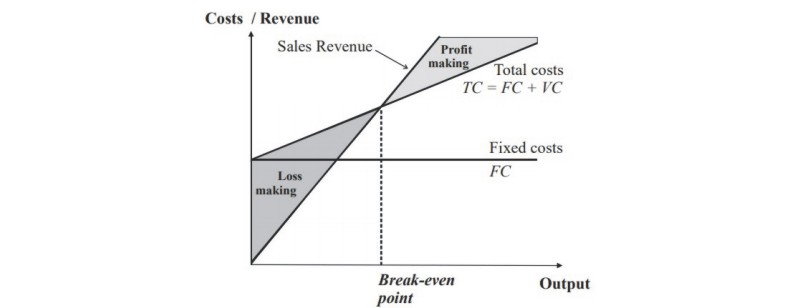

From this point it is possible to calculate the breakeven point.

|

|

|

|

|

The break-even point is where revenue is equal to total costs.

|

|

|

Example — Fixed and Variable Costs

|

|

|

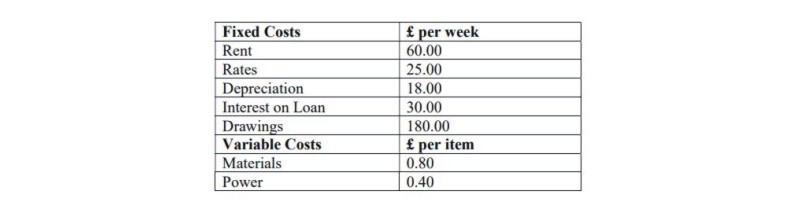

Paul is a sole trader. His business manufactures ornamental boxes. His costs are shown below

|

|

|

|

|

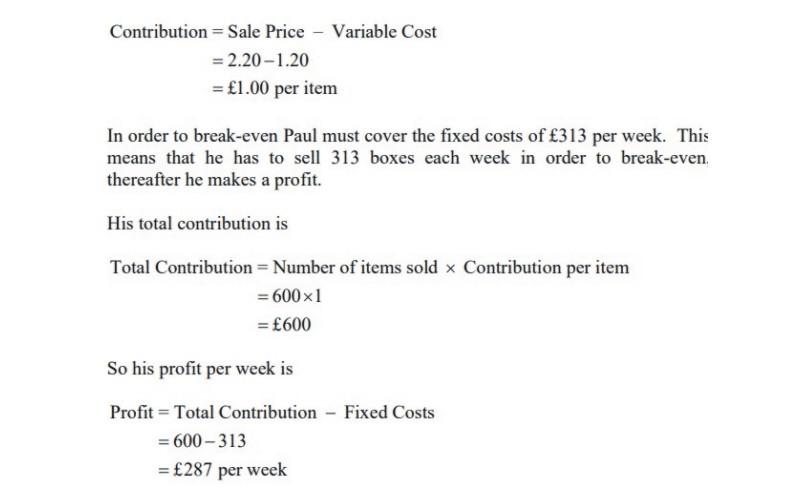

Paul makes 600 boxes per week which he sells for £2.20 each. Calculate his break-even point and his weekly profit, showing your working.

|

|

|

Solution

|

|

|

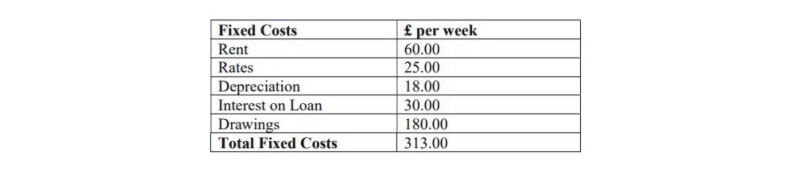

Firstly, we total the fixed costs

|

|

|

|

|

Each week, before Paul can make a profit, he has to cover these fixed costs.

|

|

|

The contribution for each box is the sale price less the variable cost.

|

|

|

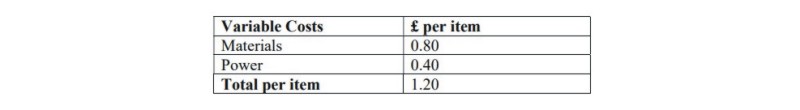

The variable cost for each box is

|

|

|

|

|

Thus the contribution per item is

|

|

|

|

Cost centres, revenue centres, profit centres |

|

A cost centre is a department within a firm where costs arise, and can be calculated. A revenue centre is a department within a firm where sales are made. A profit centre is both a revenue centre and a cost centre, hence profits, which are revenue less costs, can be calculated for a profit centre.

|

|