|

Profit & Loss Account |

Accounts |

|

Financial accounts are records of the payments and receipts made by a company in the creation of their profits — or losses. They are also statements of the assets of the company.

|

|

|

Financial accounting uses the distinction between direct costs and indirect costs in order to analyse where costs arise, and hence profitability.

|

|

|

As the distinction between direct and indirect costs implies, costs arise in two ways — either directly through the cost of raw materials and labour involved in the production of a specific unit of output, or indirectly through the administration costs of running the business as a whole.

|

|

|

This applies to all businesses, but particularly applies to those businesses that produce more than one product. Here they are sharing the administrative cost of running the whole firm amongst several products. Indirect costs arise in a different way to direct costs, and are treated differently by accountants and businessmen.

|

|

|

Success in business means ruthless scrutiny of costs. Whatever the business, costs must be examined carefully, and kept down wherever possible.

|

|

|

The control of expenditure tends to differ according to whether the cost is direct or indirect. For example, direct costs are kept down by making better deals with suppliers of raw materials, and productivity deals with the workforce. They might be improved by changes in production technique.

|

|

|

Indirect costs, however, refer largely to the cost of management, and these are kept down by efficient management. It is not efficient, for example, to have too much factory space. The cost of this good must be divided in some way between the products, and too much space means that each product is costing more to produce than necessary.

|

|

|

Direct costs are also called costs of sales and indirect costs are sometimes called overheads.

|

|

Profit and loss |

|

We will now explore how profit and loss arises and is recorded in a statement of the company records, that is, as a statement of profit and loss.

|

|

|

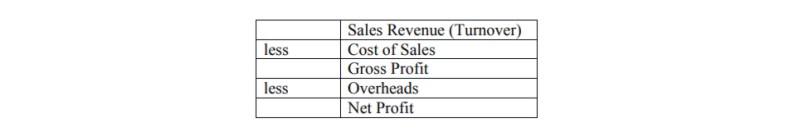

We firstly take the total sales revenue, also called turnover, and subtract from it the cost of sales, which are the direct costs, to arrive at the gross profit. Then we subtract from the gross profit the overheads, which are the indirect costs, to arrive at the net profit.

|

|

|

|

|

One question we might ask is: from where do the figures that go towards these totals come?

|

|

|

The answer is that they come from the books, ledgers, journals that a company keeps in which they record their business transactions. All transactions are either payments or receipts, so all these payments and receipts can be totalled to arrive at the total payments — the total costs — and the total receipts — total revenue.

|

|

|

In the simplest sense — profit is total receipts less total costs.

|

|

|

But costs are analysed for business purposes into direct and indirect costs. These subtotals arise quite naturally from the books, since the entries in the books are made according to the type of cost involved — for instance, costs for heat and light, costs for raw materials — also called purchases.

|

|

|

Direct costs are also called costs of sales; indirect costs are often also called overheads, and net profit is also called operating profit.

|

|

|

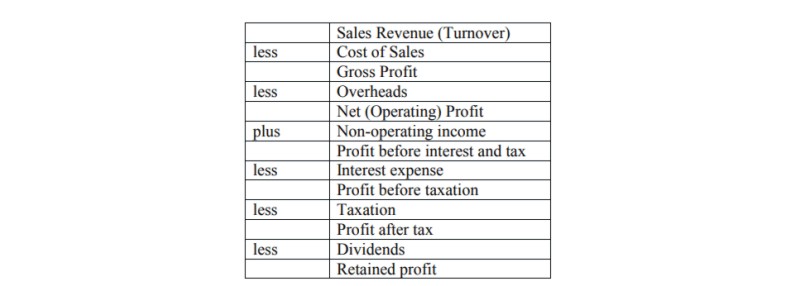

Once a company knows its operating (net) profit, it knows what is “in the pot” — that is, what can be shared out. However, the profit and loss account also shows how this operating profit has been shared out .

|

|

|

Profits can be used in the following ways. Firstly, profits are used to pay taxes. Secondly profits can be given to the owners of the business (that is, usually, the share-holders) as a reward for their investment; thirdly, profits can be retained in the business as a source of renewed investment.

|

|

|

Payments to shareholders are called dividends; payments to the owners of a business that are taken as and when needed or required, are called drawings.

|

|

|

This deals with how profits can be shared out between the state (tax), the owners (dividends or drawings) and those profits kept by the company (retained earnings).

|

|

|

However, income can also come into the company through means other than the production of the good or service that the company makes. For example, a bank may have bank deposits that bring in interest. This kind of income is called non-operating income, and is added onto the profit and loss account after the net (or operating) profit has been calculated. It must be added on because it is an income and therefore taxable. It is added afterwards, because it is not a revenue that arises through the normal operation (trading) of the business. It is, therefore, not a part of the operating profit.

|

|

|

There is another way in which companies may pay out money. Companies often finance their investments by borrowing from a bank or another financial institution or individual. They have to pay interest on such loans. The interest they have to pay is regarded as a deduction from net (operating) profit, because it is the price of the investment and not a cost of the production of the goods (not a cost of sale), nor a cost of the management of the business (an overhead). However, interest payments must appear in the profit and loss account too.

|

|

|

So a complete profit and loss account can be written as follows.

|

|

|

|

|

Questions

|

|

|

1. What is the distinction between dividends, drawings and salaries?

|

|

|

Dividends are paid to shareholders. Dividends are drawn from profits. A proportion of the profits are paid to the shareholders who by owning shares own the company.

|

|

|

Drawings are sums of money taken by the owners of the company (the directors) as and when needed to meet their personal needs.

|

|

|

2. What is non-operating income? How is non-operating income generated? Why isn’t non-operating income included in the operating profit? Why must non-operating income be added into the profit and loss account?

|

|

|

Non-operating income is income generated from such things as bank deposits, investments in stocks and shares. It is called non-operating income because it does not derive from the operation of the company, but from the financial assets of the company. Therefore, it is not income arising from the day-to-day business of the company. So it is not included in the operating profit. On the other hand, it is still income, so it has to be added onto the income of the company as a whole.

|

|

|

3. Why is it desirable for businesses to have retained profits?

|

|

|

Retained profits are used by the company to invest in further capital expenditure and to generally take the company forward. Without retained profits the company must either stagnate or obtain further finance from outside the company.

|

|