|

The Balance Sheet |

What does the company own? |

|

The balance sheet answer the question: what does the company own? We all keep a balance sheet of our own assets in our heads, and sometimes on paper too. The balance sheet of a company is just a more formal statement of the procedures we go through. We ask ourselves such questions as: what do I own? Do I have any immediate payments to make? By what date must I pay off the loan for the car? Does anybody owe me money, and if so, when am I likely to get it?

|

|

|

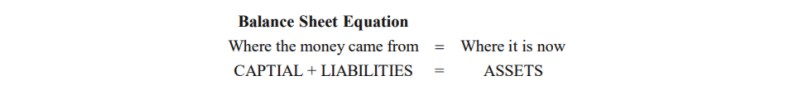

This gives us the Balance Sheet Equation.

|

|

|

|

|

An individual decides to set up a business. Let us imagine that he has $10,000 of his own money. He then goes to a bank, and they agree to lend him a further $10,000. He spends $12,000 on plant and machinery, and holds the $8,000 in cash ready to pay the rent and his staff and meet his other bills on the day that he starts trading. At this point his capital is still $10,000, and he owes the bank $10,000. This is called a liability. Within the business he has assets of $20,000 which are divided into fixed assets of plant and machinery at $12,000 and liquid assets, which we will also call current assets of $8,000.

|

|

|

If the bank demands back its $10,000 immediately, he will not have enough cash to meet the liability, and he may go out of business. Of course, that would not be good for the bank either, and the bank presumably lent him the money because they thought he could be profitable.

|

|

|

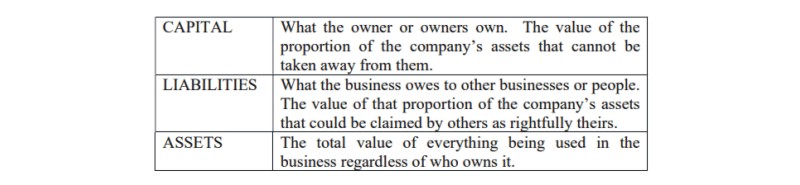

Thus, we can define the components of the balance sheet as follows.

|

|

|

|

|

The value of the business to the owners is clearly given by the equation

|

|

|

This enables us to understand the principle behind a balance sheet, which acts as a statement of the company’s capital, assets and liabilities.

|

|

|

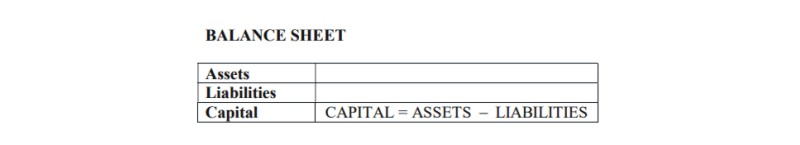

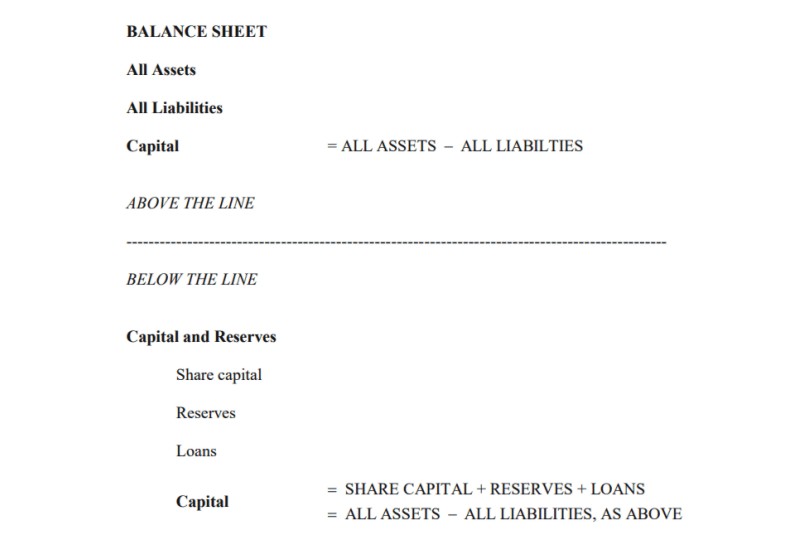

The information is usually presented in a vertical column. All the assets are listed first, then all the liabilities, and finally the total capital is derived as assets less liabilities.

|

|

|

The simplest form of the balance sheet looks as follows.

|

|

|

|

|

Exercise 1

|

|

|

[Solutions at end]

|

|

| 1 | | What is meant by capital? |

| 2 | | What is the difference between capital and money? |

| 3 | | What is meant by a liability? |

| 4 | | What is meant by an asset? |

| 5 | | Are all the assets employed in a company generally owned by the owners of the company? |

|

|

Current Assets and Liabilities |

|

As individuals we keep a mental (or physical) note of our assets in the following way. Most people's house is their largest asset. A house-owner knows how much the house is worth (an asset), how much he or she owes to the bank (the outstanding mortgage) and hence what his or her capital is worth — that is, how much of the house he or she actually owns. Most people's houses are owned principally by a bank or building society, but that does not prevent them living in their own houses.

|

|

|

This kind of ownership is highly relevant to businesses too. Businesses have fixed assets which they have bought with borrowed money, but that does not prevent them using those fixed assets.

|

|

|

However, there is another question which is very important to both businesses and individuals. It is the question: how much will I have to pay out next week, or within a coming period of time, and will I have the cash to meet it?

|

|

|

The answer to this question is found in the same way for both businesses and individuals. We add up what we have now, what we expect to earn or receive in cash in the near future and we subtract the bills.

|

|

|

If the bills exceed the immediate income then we can expect to run out of cash! This is called a cash flow crisis or a breakdown of liquidity! We might not have enough money to meet the immediate bills, even if our house is worth millions. That can be embarrassing, boring and disastrous. In the worst case scenario, the people we owe money to (called our creditors) will demand payment through legal action, and this will force us to sell our house, or other fixed assets. Sale of fixed assets, especially at short notice and under pressure, invariably results in their being converted to less cash money than we paid for them in the first palce.

|

|

|

The closure of a business, the conversion of fixed assets into liquid assets, with their usual loss of value, is called liquidation.

|

|

|

Bankruptcy occurs when an individual has no fixed assets at all! Individuals become bankrupt, but businesses go into liquidation.

|

|

|

Businesses need to know whether they are facing a cash-flow crisis or not. To this extent they include in their balance sheet a statement of the immediate payments due, and the immediate receipts expected. These are called current liabilities and current assets respectively.

|

|

|

Therefore, current capital, which is the capital from which the company meets its immediate liabilities (or debts) is equal to current assets less current liabilities.

|

|

|

Since current capital is the capital from which the company works, it is also given the name working capital. It is called by accountants net current assets, which is more accurate.

|

|

|

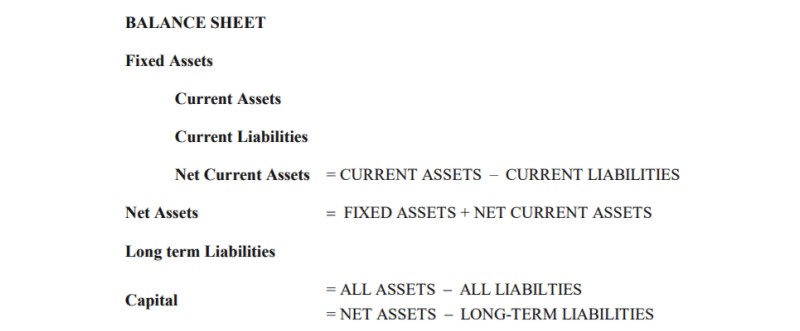

Thus

|

|

|

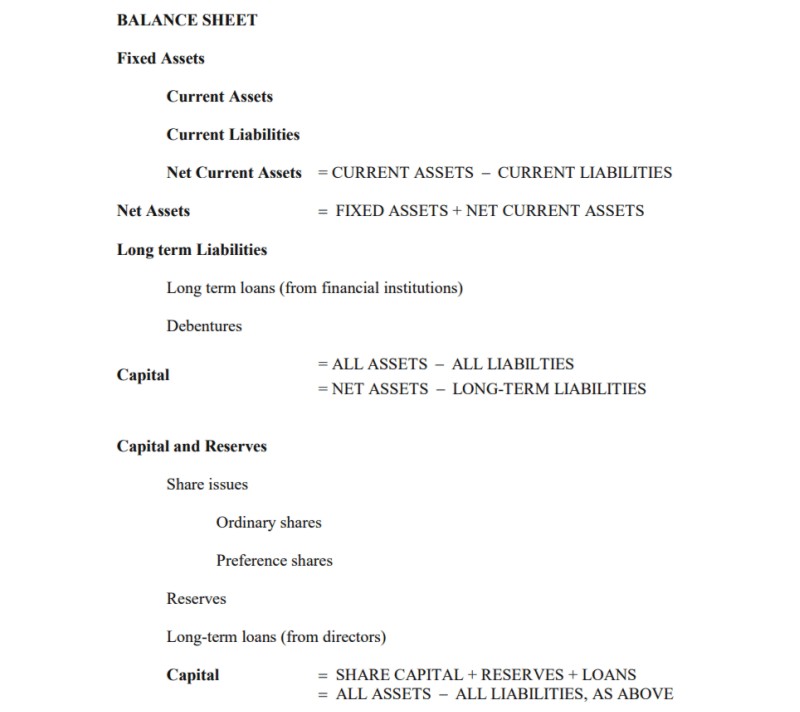

Hence the Balance Sheet takes the following form

|

|

|

|

|

Two new terms have been introduced into this balance sheet. Firstly, net assets, which is the idea of all the assets employed in the company once the current liabilities have been subtracted. It is equal to the sum of the fixed assets and the net current assets (also called, working capital).

|

|

|

Secondly, long-term liabilities. These are such things as long-term loans. They are liabilities, but are not due for payment immediately, so they are shown after the net assets.

|

|

|

Furthermore, it is clear that all the total capital in the company, that is all value of the assets owned wholly by the owners of the company, are the net assets less the long-term liabilities.

|

|

Creditors and debtors |

| Creditors are the people to whom we owe money for goods and services supplied by them to us on credit.

|

|

|

Debtors are the people who owe us money for goods or services we have supplied to them. They are our debtors.

|

|

|

It is quite easy to mix up the terms, and get them the wrong way around, especially as they are “relative” terms — for example, I am a debtor to my creditors!

|

|

|

To learn these terms — start with credit. You buy on credit, therefore you are a creditor, and the credit purchases that you have yet to pay is part of your liabilities. Individuals and companies that owe you payment are in debt to you, and are your debtors, and consequently constitute part of your assets.

|

|

|

Exercise 2

|

|

|

[Solutions at end]

|

|

|

1. What do the following terms mean?

|

|

|

(a) Debtor, (b) Creditor, (c) Current asset, (d) Current liability, (e) Solvent, (f) Cash flow crisis, (g) Bankrupt, (h) Liquidate, (i) Net current assets, (j) Long-term liabilities, (k) Net assets, (l) Capital.

|

|

|

2. What is limited liability? How does limited liability protect entrepreneurs and investors from bankruptcy?

|

|

Capital and Reserves |

|

There are three legal forms of business: sole trader, partnership and limited liability company.

|

|

|

Most businesses are limited liability companies. The word “company” normally means a “group of people”, and that is also what a company in the business sense is.

It is two or more people who have got together with the purpose of doing business. These people become shareholders of the company, and, especially when the list of shareholders is still small, and the shareholders are also directors of the company, they are called “partners”. Thus, shareholders are also partners in a business venture.

|

|

|

But what is the need for “shares” — what are they, and what are their advantages? To answer this question: suppose someone came to you and proposed that the two of you form a business together. That person suggests that he will put $0.5m into the business and work 5 hours a week, and you will put $50,000 into the business and work 100 hours a week. Would you agree to the partnership? The answer is, that you might, because in life we are generally always making the best deal we can at any given time, and even if this deal is uneven, it may be a good deal for you. For example, you might not be able to run the business without the addition of the $0.5m so you are prepared to enter into the partnership even though you think it is uneven. On the other hand, you might want the ownership of the company and the distribution of the profits to reflect the unevenness of the deal. And this is where shares come in.

|

|

|

Suppose there are 100 shares in the company. Then these 100 shares could be divided between the partners on the basis that one gets 60 shares and the other 40 shares, or on some other basis. In this case, the first partner owns 60% of the shares and receives 60% of the profits, and the second partner owns 40% of the shares and receives 40% of the profits.

|

|

|

The money the partners (or shareholders) put into the company is the original “share capital” that they use to get the company going.

|

|

The balance sheet |

|

The balance sheet uses the equation

|

|

|

We have seen that all the assets are listed, followed by all the liabilities. Finally, the value of the company that belongs to the shareholders, is calculated, and this is their capital.

|

|

|

This shows the total capital of the company, but does not show how that capital has been created. We need also a separate statement in the balance sheet of the origin of the capital — the value of the company that the shareholders own.

|

|

|

There are three main sources of capital to a company represented in the balance sheet:

|

|

|

Share capital

|

|

|

This is the total amount of capital that arises from the investment of the shareholders in the company.

|

|

|

Loans

|

|

|

These are not bank loans to the company, which have to be paid back to people who do not own the company, and are therefore liabilities. The company's capital can come from loans made by the directors and shareholders of the company to the company. The shareholders can finance the company by buying shares; but they may prefer to simply lend the company money instead. These loans are shown separately from the share capital of the company.

|

|

|

Reserves

|

|

|

Reserves are retained profits. As the company trades on a year on year basis it may make profits. Some of these profits may be distributed to shareholders as dividends, and some retained for use within the company. These retained profits are said to be transferred to the “reserves” of the company. It is an internal source of further investment finance in the company.

|

|

Types of share |

|

A share represents ownership of the company. But over time it has been found useful to distinguish between three kinds of ownership of companies, because the needs of shareholders are not all the same.

|

|

|

Ordinary shares

|

|

|

An ordinary share is a certificate stating legal ownership of a part (or share) of a company. Ordinary shares in public limited companies can be sold to other investors, and there is no obligation on the part of the company to buy the shares back (or “redeem” them). Ordinary shares are a source of permanent finance (capital) for the company. The company pays a return to the investor in the form of a dividend. Holders of ordinary shares own the company, and as such have the right to attend the Annual General Meeting of shareholders, look at the accounts, vote on matters of policy and appoint the directors and management of the company.

|

|

|

Preference shares

|

|

| A preference share is a certificate stating legal ownership of a part (or share) of a company, but in a special sense. A preference shareholder generally receives a fixed rate of dividend that is paid before other dividends, that is, before the dividend to the ordinary shareholders. There is no obligation on the company to pay the dividend, so if the company is doing badly then the directors may decide not to pay the dividend. The preference shareholder also has a preferential entitlement to the proceeds of the assets of the company should the company have to be liquidated. However, in return for this extra security, the preference shareholder usually does not have the right to vote at the Annual General Meeting. Possession of a preference share is a mid-way state between owning a business and lending money to it. As the dividend does not have to be paid, the capital coming from preference shares is treated in the balance sheet as a form of ownership. If a dividend is not paid to a preference shareholder for some reason, this is usually made good in subsequent years.

|

|

|

Debenture

|

|

|

A debenture is not really a share at all, but is a form of loan to the company from people who do not own the company — so strictly speaking, it is a liability of the company, not the capital of the company. It is a fixed interest loan, and is paid back (redeemed) at some later stage. In the balance sheet debentures appear as one of the long-term liabilities of the company, and are not listed as part of the capital of the company. However, they are like ordinary and preference shares in that they can be bought and sold by other investors. As a result, ordinary and preference shares together with debentures are collectively known as securities and all three can be quoted on the stock exchange.

|

|

|

In conclusion — each category of finance to the company — debentures, preference shares, ordinary shares, retained profits (reserves), loans from shareholders, and loans from other financial institutions, are all shown in the balance sheet in different ways. Some are regarded as liabilities (debentures, loans from financial institutions) and some as capital (preference shares, ordinary shares, retained profits, loans from shareholders).

|

|

|

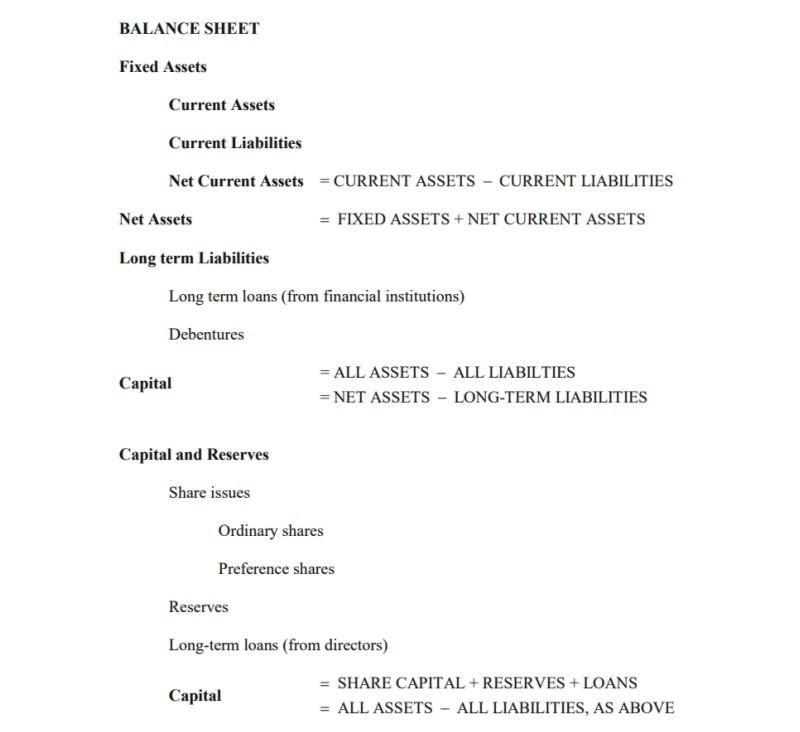

The balance sheet becomes:

|

|

|

|

|

The term “capital” appears twice in the balance sheet; firstly at the end of the calculation of all the assets less all the liabilities; and then, at the end of the calculation of all the sources of the capital. The two figures must be identical.

|

|

|

There is a sort of “mental division” between the two parts of the balance sheet. The first half concludes with the calculation of the capital in the sense of capital being equal to all the assets less all the liabilities; the second part concludes with the calculation of the capital in the sense of capital being the sum of all the sources of finance in the company. This mental division is sometimes referred to as an imaginary “line”, and people talk of “above the line” and “below the line”.

|

|

|

This is illustrated by the following form of the balance sheet

|

|

|

|

|

Exercise 3

|

|

|

[Solutions at end]

|

|

| 1 | | What is meant by the term reserves? |

| 2 | | Why do we distinguish between loans and bank loans? |

| 3 | | Why are loans from directors generally more important to small companies than to large companies?

|

| 4 | | Make two lists showing (1) the similarities between ordinary and preference shares; and (2) the differences between ordinary and preference shares.

|

| 5 | | Why are debentures regarded as long-term liabilities, and not as capital? |

| 6 | | Why would you be prepared to pay more than $1 for a share with a nominal value of $1? |

| 7 | | Why do companies that are quoted on the stock exchange need a minimum share issue? |

| 8 | | How do companies distribute profits? |

|

|

|

Share premium |

|

|

|

|

A share has a nominal value. This is the value of the share printed on the share. For example, a $1 share has a nominal value of $1 — which seems obvious! However, just because the value $1 is printed on a share certificate, this does not mean that the share is worth only $1, and can only be sold for $1. If the company is doing well, it may be able to sell a share with a nominal value of $1 for more than $1. The difference between the nominal value and the market value of the share may be called the share premium.

|

|

|

Share premium is sometimes a source of finance to a company, though generally it is not. If a company sells a nominal share of $1 for just $1, then it gains no share premium. If later an investor sells that share for $3, then it is the investor who gains the premium, not the company, and this is not a source of finance for the company. On the other hand, sometimes the company is also able to sell a share, originally valued at, say, $1, for more than $1, and in this case the additional capital that comes into the company is a source of finance to the company, and is recorded in the balance sheet as share premium.

|

|

Analysis of Assets and Liabilities |

|

We have seen the following form of the Balance Sheet

|

|

|

|

|

However, we must now specify what the fixed assets are (in more detail), and what the current assets and liabilities are (also in more detail).

|

|

|

Subdivisions of fixed assets

|

|

|

It is usual to subdivide the fixed assets into smaller categories. These categories will differ from business to business, since each business is different and holds different kinds of asset. For example, fixed assets are sometimes divided into premises, plant & equipment, vehicles, land, fixtures and depreciation.

|

|

|

Subdivisions of current assets

|

|

|

Current assets are divided into stock, debtors, cash at bank and other current assets.

|

|

|

Stock refers to stocks of raw materials, finished goods and partly finished goods currently held by the company. These stocks must all be valued in monetary terms, and stock evaluation is a separate topic. The company expects, under normal circumstances, to be able to convert all these items into cash in the near future, and when this is done to receive payments for them.

|

|

|

Debtors are the people and companies that owe money to the company. They owe the company for goods and services already provided.

|

|

|

Provision for bad debts

|

|

|

Unfortunately, not everyone does pay their debts. So it may be necessary to subtract from the current assets a sum entitled provision for bad debts. Companies who have bad debtors may decide to subtract a fixed percentage of their debtors as a provision against non-payment of debts.

|

|

|

Subdivisions of current liabilities

|

|

|

Current liabilities are subdivided into creditors, provision for tax, overdraft and anything else that has to be paid, such as a dividend.

|

|

|

Creditors represent the money owed by the company to other individuals and companies for goods and services that have already been provided. These sums must be paid in the near future, and if they are not paid, this will cause the company a credibility crisis, and could lead to the creditors suing for their money, and to the collapse of the company.

|

|

|

If a company expects to pay tax, it must make a provision for it, and this is entered as a liability.

|

|

|

Many companies have an overdraft. This is money owed to the bank, and is consequently a liability.

|

|

|

If a dividend has to be paid, it is noted as a current liability. When it is paid it is subtracted from the profit and loss account as dividend paid, and so reduces the reserves by the amount subtracted.

|

|

Conclusion |

|

Balance sheets are very interesting things, and knowing how to read a balance sheet makes you a knowledgeable student of business.

|

|

|

Exercise 4

|

|

|

[Solutions at end]

|

|

| 1 | | Using examples, explain the difference between fixed assets and current assets. |

| 2 | | In what sense can fixed assets be regarded as being used up in the production cycle? |

| 3 | | Are creditors assets or liabilities? Are debtors assets or liabilities? | | 4 | | What are bad debts? How can bad debts cause a company to have a cash flow crisis?

|

| 5 | | Under what circumstances is it a problem for a company to run its production cycle on an overdraft? |

| 5 | | Where does a dividend that has been paid appear in the Balance Sheet? Where does a dividend that has not been paid appear in the Balance Sheet?

|

|

|

Solutions to exercises |

|

Exercise 1

|

|

|

1. What is meant by capital?

|

|

|

In the context of the balance sheet capital means the value of the assets owned by the owners of the company (the shareholders if it is a limited liability company) once all the debts (liabilities) that the company has have been deducted.

|

|

|

2. What is the difference between capital and money?

|

|

|

Capital comprises the physical and non-physical assets (such as education and skills) used in making goods and services. Money is primarily a means of exchanging one good for another. Capital is measured in monetary terms, and since money (cash) buys physical assets (for example, buys a factory), capital is often thought of as money. But strictly speaking, they are different concepts.

|

|

|

3. What is meant by a liability?

|

|

|

A liability is something owed by the company to some other company or individual. It is a debt.

|

|

|

4. What is meant by an asset?

|

|

|

An asset is a something employed in the company to make goods or services. For example, a photocopier could be an asset. Also, cash at bank is an asset because it can be used to pay the business's bills.

|

|

|

5. Are all the assets employed in a company generally owned by the owners of the company?

|

|

|

In short — NO! That is the whole point of the balance sheet. When you have a business you have assets that are used to make goods and services. In order to acquire these assets you may have money of your own, and once this is invested in the company, this forms part of the company's capital. But you may also go to a bank and borrow some money. You have to pay the money back (with interest) so it is a liability, but you can use the money you have borrowed to buy assets and so conduct the business.

|

|

|

Exercise 2

|

|

|

1. What do the following terms mean?

|

|

| (a) | | Debtor: A debtor is someone who owes the company money. |

| (b) | | Creditor: A creditor is a company or individual to whom the company owes money. |

| (c) | | Current asset: A current asset is something like cash, or near cash, that can be used immediately to pay a bill. |

| (d) | | Current asset: A current asset is something like cash, or near cash, that can be used immediately to pay a bill. |

| (e) | | Solvent: This means that the company has sufficient cash to meet its bills. Or, more technically, the company has more current assets than current liabilities. |

| (f) | | Cash flow crisis: This is the opposite of solvent. It means that the company does not have enough cash to meet its bills. The term can, of course, be extended to individuals — in other words, people sometimes are not able to pay their bills. |

| (g) | | Bankrupt: This applies to an individual rather than a business. An individual is bankrupt when he/she has no capital and there are unpaid bills. |

| (h) | | Liquidate: This means to close the business, make the staff redundant, and sell the assets of the business in order to turn these into cash (liquid assets). |

| (i) | | Net current assets. This is the technical term for the current assets less the current liabilities. |

| (j) | | Long-term liabilities. These are such things as long term loans from banks and other financial institutions that do not have to be paid back immediately.

|

| (k) | | Net assets: This is just the technical term in accounting for the net current assets plus the fixed assets. In other words, the assets employed in the company after the current liabilities have been deducted, but not taking into account the long-term liabilities. It is a measure of the assets available to the company for immediate use in the conduct of the business. |

| (l) | | Capital: In accounting terms this is the value of the all the assets in the business once all the liabilities, both current and long-term, have been deducted. |

|

|

|

2.What is limited liability? How does limited liability protect entrepreneurs and investors from bankruptcy?

|

|

|

Limited liability means that the owners of the company — the shareholders — can only be made in law to pay that money that they have invested into the company. They cannot be made to pay more. This protects them from bankruptcy because it means that they are not liable for any errors of the business.

|

|

|

Exercise 3

|

|

|

1. What is meant by the term reserves?

|

|

|

Reserves come from retained profits. At the end of each year a company makes a profit or a loss. Let us suppose that it makes consistent profits. These profits are either given to the shareholders in the form of dividends or kept by the company. If they are kept by the company they are said to be transferred to the reserves of the company. They are also said to form retained earnings.

|

|

|

The company will then go on to use these retained profits to purchase new assets and so continue the business. Thus, whilst reserves are valued in monetary terms, this does not mean there is necessarily a bank account with a sum of money deposited in it to the value of these reserves.

|

|

|

2. Why do we distinguish between loans and bank loans?

|

|

|

By loans we mean director's loans. In small companies the directors are the shareholders. The directors then choose to lend to the company some of their own money. This is a loan. The loan capital appears below the line in the balance sheet, because, although the directors hope to have it paid back it is not necessary to pay it back. Loan capital is not a liability of the company.

|

|

|

Bank loans are loans made to the company by banks! The banks have no shareholder interest in the company, so loan capital cannot be regarded as part of the capital of the company. The loan has to be repaid (with interest), and the loan is a liability, so must appear above the line in the balance sheet.

|

|

|

3. Why are loans from directors generally more important to small companies than to large companies?

|

|

|

Small companies raise their finance in different ways to large companies. Small companies are largely financed by the loans made to them by the directors, who are also the shareholders in the company. Large companies are financed by several sources including shareholder capital, bank loans and retained profits. However, the directors may be shareholders in the company but usually only in a small way. They do not personally lend the company money, but rather manage the money lent to the company by others.

|

|

|

4. Make two lists showing (1) the similarities between ordinary and preference shares; and (2) the differences between ordinary and preference shares.

|

|

|

Similarities: both are legal documents indicating ownership of a company. Both entitle the owner (the shareholder) to receive a share of profits in the form of dividends. Both entitle the owner to attend the annual general meeting of shareholders.

|

|

|

Dissimilarities: ordinary shares confer full ownership of the company. The ordinary share holder has a right to vote on issues at the annual general meeting, but the preference shareholder does not. In return for the added security of having dividends paid to him preferentially the preferential shareholder forgoes the right to direct the management of the business. The preference shareholder obtains dividends before the ordinary shareholder.

|

|

|

5. Why are debentures regarded as long-term liabilities, and not as capital?

|

|

|

Although debentures can be bought and sold, for example, on the stock exchange, they are loans to the company rather like bank loans. The company has to pay the interest on the debentures and has to pay back the sum borrowed at the maturity date of the debenture. So really, a debenture is like a bank loan, and like a bank loan is a liability of the company.

|

|

|

6. Why would you be prepared to pay more than $1 for a share with a nominal value of $1?

|

|

|

If the assets of the company have increased in value, and if the company is profitable, then the value of the share will increase above its nominal value.

|

|

|

7. Why do companies that are quoted on the stock exchange need a minimum share issue?

|

|

|

This is a form of protection for shareholders. The fact that there is a minimum share issue prevents the company from being too small to trade effectively and conduct its business.

|

|

|

8. How do companies distribute profits?

|

|

|

They distribute them to shareholders in the form of dividends. The dividends appear as cheques made payable to the shareholders on their doormats!

|

|

|

Exercise 4

|

|

|

1. Using examples, explain the difference between fixed assets and current assets.

|

|

|

Fixed assets are such things as machines and buildings used by the company. Current assets are stocks, debtors and cash used in the day to day running of the business. For example, in a photocopying shop the photocopier is a fixed asset, the paper used to feed it is a stock, the people who owe the company for completed printing jobs are the debtors, and the money in the till is cash.

|

|

|

2. In what sense can fixed assets be regarded as being used up in the production cycle?

|

|

|

Fixed assets depreciate. They wear out and have to be replaced. In the long run, they are used up.

|

|

|

3. Are creditors assets or liabilities? Are debtors assets or liabilities?

|

|

|

Creditors are liabilities. They are the businesses and people to whom the business owes money. Debtors are the businesses and people who owe the business money, and so are assets of the company.

|

|

|

4. What are bad debts? How can bad debts cause a company to have a cash flow crisis?

|

|

|

Bad debts arise from companies and individuals who are unable or unwilling to pay their debts to the company. The company may seek to recover these sums by court action, but when even that fails they become bad debts.

|

|

|

5. Under what circumstances is it a problem for a company to run its production cycle on an overdraft?

|

|

|

It is a problem if the bank decides for some reason to insist on the overdraft being paid back. Overdrafts are strictly payable on demand, so any company with an overdraft might be closed down by their bank. However, many companies do have overdrafts. This is a form of borrowing working capital and represents a source of finance to companies, and a source of income to banks.

|

|

|

6. Where does a dividend that has been paid appear in the Balance Sheet? Where does a dividend that has not been paid appear in the Balance Sheet?

|

|

|

When a dividend is paid it is subtracted from the profits. In other words, it shows up in the balance sheet as a subtraction from the retained earnings (or reserves) of the company. (Strictly speaking, dividends are subtracted first, so they never appear as reserves as such.)

|

|

|

If a dividend is liable to be paid, then it must appear as a current liability. When the dividend is paid, the cash of the company is reduced by the amount of the dividend.

|

|