|

Investors and the Corporate Life Cycle |

Analysis for Investors |

|

1. Who are investors? How do investors earn money from a business?

|

|

|

Investors are shareholders of a business. They are the people who own the business. Investors earn money from a business by being paid dividends, which are a proportion of the profits of the business. In addition to receiving dividends investors can also make profits on the buying and selling of shares. If an investor is unsatisfied with the dividend he has been paid, he can liquidize his assets by selling some or all of his shares in the company.

|

|

|

2. What causes the price of an ordinary share to increase?

|

|

|

The price of an ordinary share in a company will increase if the company is making above average profits.

|

|

|

3. Under what circumstances will the price of an ordinary share rise even if a company is not paying out any dividend?

|

|

|

The price will rise if the company is making a profit, or can be expected to make a profit in the future. A company does not have to pay out a dividend, and the management of the company may prefer to retain the profits in order to reinvest them. However, if the company is doing well, the future remains bright, and higher dividends can be expected. So the market price of the share will increase.

|

|

|

4. Suppose a company is doing well, but does not pay a dividend. An investor in that company is unwilling to wait for the company to pay out a dividend, what can she do?

|

|

|

The investor can sell all or part of her shares. In this way she liquidizes her assets.

|

|

|

5. Why sould investors been interested in calculating and tracking the profitability and liquidity performance ratios of a company?

|

|

|

The profitability and liquidity ratios are of interest to an investor because they help him determine how the business is doing. The investor is able to see from the Company accounts the extent to which the Company is profitable and liquid. Ultimately the company is worth investing in because it can make profits and can stay in business.

|

|

|

6. What else might an investor what to know?

|

|

|

Investors would want to know in one way or another how the dividend they were awarded compared to the dividend or rate of interest they would make with other investments.

|

|

|

They would want to be able to compare at a glance the value of the dividend per share in one company with the values of the dividend per share in other companies.

|

|

|

Investors might accept a lower rate of dividend if they felt that the company was making and retaining profits for good reasons — for future investments. In that case, they would want to know how the profit of the company compared to the profit other companies were making.

|

|

|

The total profit made by the company is ultimately more important than the dividend to the shareholder, because, provided profits were being made, the shareholder can sell some or all of his shares if he wishes or needs to do so. Thus, primarily, the investor wants to know how much profit per share is being made, and how this compares with other investments. Some investments may take time to pay off. In such long-term cases the investor wants to know whether the company is on track to make substantial future profits which will justify not receiving an increase in wealth right now.

|

|

|

Profits increase shareholder's wealth.

|

|

|

Investment is also a risky business. Therefore, investors want some idea of the risk involved in investing in the company. To some extent the performance ratios, and particularly the liquidity ratios, answer this question. But investors will want to know the extent to which the company is indebted to other bodies who are not share-holders and who can, therefore, demand payment of the company's liabilities. In other words, they will want to know the extent to which the company is vulnerable to a liquidity crisis, for reasons other than the management of the working capital cycle.

|

|

|

If the company were to go into liquidation, it would be useful to know whether the company's assets would be worth anything, and if so, how much of these net assets would be attached to each share. If the assets were considerable, and the value of the assets per share were large, this might justify an otherwise risky involvement.

|

|

|

Further questions

|

|

|

1. According to modern business theory what is the primary purpose of a business?

|

|

|

The primary purpose of business is to make profits.

|

|

|

2. How can a conflict between the interest of shareholders and the interest of managers of a business arise?

|

|

|

For managers there may be other priorities than profits. A manager may be more concerned with his/her salary and power than with the overall profits of the company.

|

|

|

3. Shareholders and managers are stakeholders in a business — that is, people who are involved and have an interest in the functioning of the business. What other groups of stakeholders are there?

|

|

|

In addition to shareholders, these include:

|

|

| 1 | | Customers |

| 2 | | Employees |

| 3 | | Employees |

| 4 | | Managers and directors |

| 5 | | The government |

| 6 | | The local community |

| 7 | | The national community |

| 8 | | Environmental pressure groups |

|

|

|

|

|

|

4. Profits can be distributed in two ways: what are they?

|

|

|

Through dividends and through the increase in the value of the share as a result of the increasing value of the assets of the company and its profits.

|

|

|

5. If a company distributed all its profits as dividends could its share price rise?

|

|

|

Large dividends could attract greater demand for the shares. The price of a share is determined by the laws of supply and demand, so if demand increases the price could increase. However, companies generally retain part of their profits for the purpose of reinvestment.

|

|

|

6. How does the existence of the stock-market enable a shareholder to simultaneously hold both liquid and fixed assets? Why is this of advantage to the shareholder?

|

|

|

This question gets to the heart of the genius of the stock market and why the invention of laws making the stock market a legal entity is closely linked with industrialization. The problem with an investment normally is that it forces the investor to tie up his/her capital in fixed assets, at least for a while. However, unforeseen circumstances may arise making the investor wish to have cash instead. If all his capital is in fixed assets, then liquidating those assets could be costly. However, a share is a share in fixed assets, but because other people are prepared to buy shares it means that the fixed asset can be readily converted to cash with minimal loss of earnings.

|

|

|

7. Why is the total profit that a company is making of paramount interest to a shareholder?

|

|

|

This is because it is the total profit rather than the dividend that represents the real value of a share.

8. Can a company pay a dividend without having made a profit?

|

|

|

A company can pay a dividend by using up previously retained profits.

|

|

|

9. How does an investor that studies the profitability and liquidity ratios of a company he/she invests in reduce his/her risk?

|

|

|

Such an investor is more likely to be aware of when the company is not doing well, and to be able to sell his/her shares before the problems become clear to everyone, resulting in a collapse of the share price.

|

|

|

10. When a company is liquidated do the shareholders receive the proceeds first?

|

|

|

No! The shareholders are the last people to receive the proceeds of the liquidation. All other creditors must be paid first.

|

|

Product Life Cycle |

|

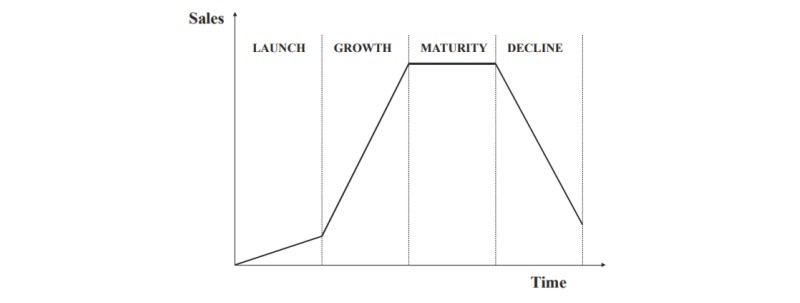

Most products and services are thought to pass through a number of phases that are rather like the birth, growth, maturation and eventual death of a living organism. The main phases are launch/development, growth, maturity and decline. The effect of these phases can be shown graphically.

|

|

|

|

|

Product life cycle

|

|

|

Clearly there can be no sales of a product until it is launched, so sales are zero until this time. Once the product has been launched sales will only grow slowly at first. This is because not all the potential clients of the product will know about it and people need time to evaluate the product at get used to it. However, after a certain point, if the launch is successful, sales will begin to pick up and there will be rapid growth. Yet every market is ultimately of finite size, so eventually the sales will reach a plateau. Finally, almost every product has substitutes, and some alternative will be produced that will appeal to customers more, and customers will switch to the new product; hence sales will decline.

|

|

Corporate Life Cycle |

|

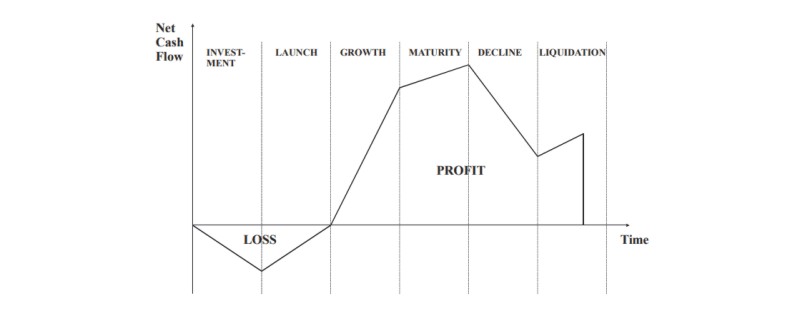

Let us imagine a company that produces just one product, and that this product is bound by fate to follow the product life-cycle.

|

|

|

In that case, the company must follow a corporate life-cycle that virtually mirrors the product life-cycle. However, before the product can be launched it must first be developed. This requires investment, so before there are any sales, there has to be a negative cash flow into the business.

|

|

|

It is at this stage that potential investors are approached by an entrepreneur and invited to take shares in the new company.

|

|

|

At this stage the company makes losses.

|

|

|

During the launch of the product continuing on-going investment is likely to be required. This may come from retained profits, but these are not usually sufficient. indeed, the company may still be making losses. Losses would mean that there must continue to be an inward investment into the company in order to sustain growth.

|

|

|

The investment can come from further share issues, or, more likely from bank finance.

|

|

|

Once the product achieves maturity, profits increase, and as these are no longer required for the on-going development of the product, they are available for distribution back to the shareholders in the form of dividends. Other things being equal, dividends reach a maximum towards the end of the maturity phase.

|

|

|

During decline, profits are still being made and dividends are being paid to the shareholders. The life of the product is coming to an end, so at some stage it becomes pointless to carry on producing it. The assets still invested in the company can be run down, and, if still of value, sold off. As the product reaches the end of its life, the company goes into voluntary liquidation.

|

|

|

|

|

The corporate life cycle

|

|

|

Questions on the corporate and product life cycles

|

|

|

1. Why does the corporate life-cycle virtually mirror the product life-cycle?

|

|

|

For a company producing a single product the company can only make profits once it starts to make sales. Profits tend to increase when sales increase, and fall when sales fall, particularly when there are large changes in the volume of sales.

|

|

|

2. In what ways is the corporate life cycle different from the product life cycle?

|

|

|

The corporate life cycle begins sooner and ends later. It begins with an investment phase and ends with a liquidation phase.

|

|

|

3. Do all companies get past the launch stage? Why is this an important question for investors to consider?

|

|

|

No! Not all companies do get past the launch phase. Investors run the risk that the investment they are making may result in zero returns and nothing but losses.

|

|

|

4. Since profits are not steady throughout the corporate life cycle, why do investors chose to invest? |

|

|

Investors expect successful products to reach a maturity phase, at which point they will make high and steady returns.

|

|

|

5. What will company managers, not willing to see their companies eventually decline, do to avoid this?

|

|

|

They will seek to (a) develop new products and (b) extend the life of existing ones.

|

|

Investors and the Corporate Life Cycle |

|

1. Why does an investor chose to invest money in a company destined to follow the corporate life cycle?

|

|

|

After a period during which the product is developed and launched, a period that requires and initial investment, it is expected that the company will make profit. It is also expected that these profits will be larger than the sums required in order to develop and launch the product. So, in the long run, the investor expects to make more money by investing than not.

|

|

|

2. What are the disadvantages of investing in a company that is at the outset of the corporate life cycle?

|

|

|

Firstly, the money that the investor places with the company cannot be spent right now, so the return must compensate the investor for not being able to use the money immediately.

|

|

|

Secondly, any investment is risky — so the investor must feel that the investment is worth the risk, and the investor expects to be rewarded for the risk.

|

|

|

The rate of return

|

|

|

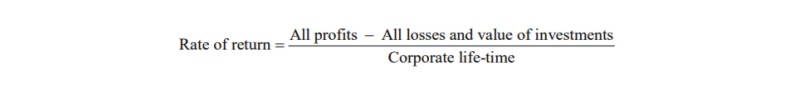

One measure of the rate of return on an investment might be as follows.

|

|

|

|

|

This rate of return can be compared with other investment options, such as putting the money in the bank, or buying government bonds.

|

|

|

We must also take inflation into account. If there is inflation, the rate of return should cover this. Thus, taking inflation into account, the rate of return on an investment represents three payments to an investor in return for the use of the investor's money.

|

|

| 1 | | A payment to the investor to cover the depreciation of the value of the money over time owing to inflation. |

| 2 | | A payment to induce the investor not to use the money now. |

| 3 | | A payment to induce the investor to take the risk involved in possibly losing part or all of his money. |

|

|

|

We call these payments premiums. Thus, the interest rate for an investment is made up of three premiums.

|

|

| 1 | | Inflation premium |

| 2 | | Time preference |

| 3 | | Risk premium |

|

|

|

We next examine the Time Value of Money in order to clarify the idea of a time preference.

|

|

|

Questions

|

|

|

1. What do we mean by the rate of return on an investment?

|

|

|

It is a pecentage return on an investment, much like the return on depositing a sum of money at a bank. In fact, the whole point of investment analysis is so as to be able to compare an investment in a business to the simpler process of depositing money in a bank.

|

|

|

2. What three premiums comprise the interest rate charged by investors?

|

|

|

The rate of return charged by investors for their money comprises of three components: a return to cover inflation, a return to cover the time preference for money, and a return to cover the risk.

|

|

|

3. How would you expect interest to vary with (a) time preference; (b) inflation premium?

|

|

|

If either the time preference or inflation go up then the interest will go up accordingly.

|

|

|

4.Must the premium investors charge for the time preference of money remain constant?

|

|

|

No! The time preference of money is an expression of the psychology of people in a country. The more people want to spend their money now the greater the time preference. The time preference is linked to the general feelings people have about pleasure.

|

|

Financial Strategy and the Corporate Life Cycle |

|

The gearing of a company is not constant — the level of gearing varies with time, and can vary with the stage of the company within the corporate life-cycle.

|

|

|

What does it mean for a company to become a public limited company?

|

|

|

A limited company becomes a public limited company when it successfully issues a portfolio and sells shares in the company to the public.

|

|

|

By way of revision of share issues, when a company seeks to sell shares there are various options:

|

|

| 1 | | Offer of Sale through an issuing house or merchant bank. |

| 2 | | In a public issue the company appeals directly to the public |

| 3 | | A placing of shares to private clients |

| 4 | | Investors may tender for the shares by bidding for them. |

|

|

|

If a company is already a public company, then it can also

|

|

| 5 | | Offer new shares to existing shareholders in a rights issue. |

|

|

|

A company that is already a public company may also sell shares to new investors through the first four mechanisms.

|

|

|

Questions

|

|

|

1. Once a company has been created as a public limited company is it fair to the existing shareholders to issue new shares to new investors?

|

|

|

If the company issues new shares to new investors it is effectively dividing the company profits between a larger number of shares. This, therefore, reduces the return on the investment to the existing shareholders, and is consequently said to dilute the existing shareholder value. It is regarded as not being fair.

|

|

|

It may, however, be practical. If the company needs additional finance it will have to raise that finance by some means or other. Issuing shares is the least risky way of raising additional finance.

|

|

|

Whether a company can issue new shares will be indicated in the company's Articles and Memorandum of Association.

|

|

|

2. “Share capital is less risky, but also less profitable”. Do shareholders agree?

|

|

|

We have to ask the question: less profitable for whom? The company exists for the purpose of maximizing the wealth of the existing shareholders. If the company sells additional shares to new investors, it dilutes the existing shareholder's wealth, and, may very well not maximize it.

|

|

|

Therefore, if a company requires additional finance, it is in the existing shareholders' interest if this finance is not obtained through the issuing of additional shares.

|

|

|

There is one possible exception to this rule- which is a rights issue. A rights issue occurs when a company offers to existing shareholders the option to buy additional shares in the company on a strict ratio basis — for example, one new share for every existing share held. Existing share holders have the right to sell the option to a third party.# |

|

|

3. Why is a rights issue considered to be the fairest way of raising additional share-capital?

|

|

|

It is fairest because if the shareholder takes up his right, he does not dilute his interest in the company. Perhaps it is unfortunate, he has to invest more. On the other hand, in many cases the need for a second injection of capital into a company may well have been anticipated, so this may not be unfair to the investor. Additional injections of capital are normal, because companies grow as their products move into the launch phase.

|

|

|

However, the existing investor would probably prefer the company to borrow from financial institutions, provided that it is safe to do so. The reason for this is that the lower rates of interest from banks and other financial institutions makes the company more profitable, and therefore provides greater profits for existing shareholders.

|

|

|

4. How does risk vary with time during the corporate life cycle, and what is the effect of this on the gearing of a company?

|

|

|

The gearing of a company is the ratio of the long-term borrowings from banks to the capital employed. As the company moves through the launch into the growth phase, and further into the maturity phase, the risk involved with that company decreases. Consequently, it becomes less and less risky to borrow money from the bank, because market share, sales and company profits are more and more stable.

|

|

|

Therefore, as the company moves through the corporate life cycle, it becomes more and more likely to raise additional finance by borrowing from a bank. In other words, the gearing goes up.

|

|

|

Once the company enters into the phase of decline, it makes sense to pay off all existing loans. So at this stage the company decreases its gearing. For a company strictly wedded to the corporate life cycle, the gearing begins at zero, increases to a maximum, and then returns to zero again.

|

|

|

Most companies will seek to extend their product life-cycles or develop new products. They will be simultaneously at various stages of the gearing cycle, and will, therefore have an average level of gearing, being the sum of all their investment needs for all their products.

|

|