|

Investment Appraisal: Average Rate of Return |

|

The accounting or average rate of return expresses the annual increase in profits resulting from an investment as a percentage of the capital cost of the investment.

|

|

Method |

| 1 | | Estimate the cash flow (net of operating costs) from the investment over its lifetime. |

| 2 | | Make a total of this cash flow. |

| 3 | | Deduct the cost of the investment (that is, deduct the capital cost). |

| 4 | | Divide this net cash flow by the cost of the investment. |

| 5 | | Divide the resultant ratio by the expected life, and express the result as a percentage (that is, by multiplying by 100). |

|

|

|

A worked example will make this clearer.

|

|

|

Example

|

|

|

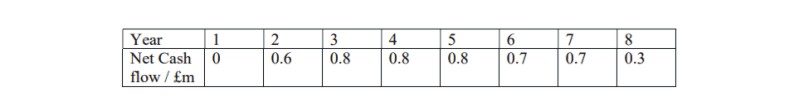

An investment costing £2m is expected to result in the following cash flows (after operating costs have been deducted). Calculate the accounting rate of return.

|

|

|

|

|

Solution

|

|

|

Step 1

|

|

|

The estimated cash-flows have already been given to you. You do not have to do anything here.

|

|

|

Step 2

|

|

|

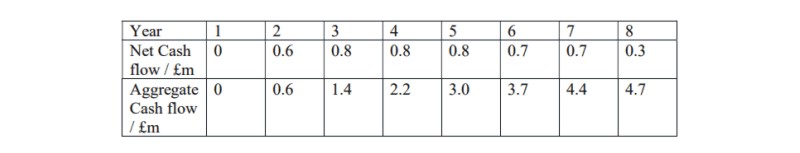

We need to aggregate (total) the cash flow; which we do as follows

|

|

|

|

|

Step 3

|

|

|

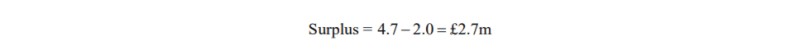

We deduct the cost of the investment (at £2m) from this total inward cash-flow of £4.7m.

|

|

|

|

|

Step 4

|

|

|

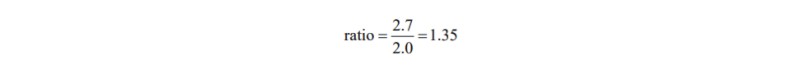

We divide this surplus by the cost of the investment

|

|

|

|

|

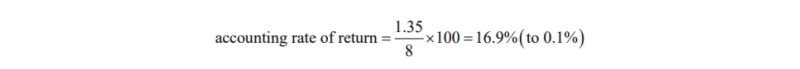

Step 5

|

|

|

We divide this ratio by the expected life, and express the result as a percentage

|

|

|

|

|

Effectively, what we are doing in calculating the Accounting Rate of Return, is obtaining a percentage return on an investment that is comparable to a bank rate of interest. In this above example we see that the investment is expected to return 16.9%. If the bank rate of interest is, say, 5%, this would appear to be an attractive investment. However, that is assuming that the return is guaranteed, in other words, this accounting rate of return that we have just calculated does not take risk into account. Additionally, it does not account for the depreciation of money owing to the time-value of money.

|

|

Exercise in the Accounting Rate of Return |

|

Question 1

|

|

|

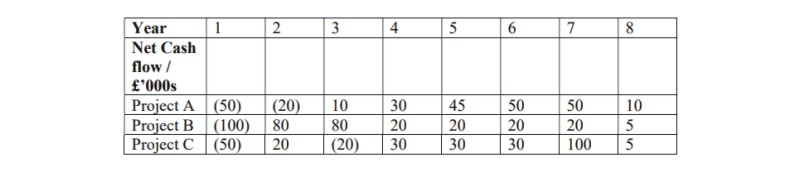

Calculate the Accounting Rate of Return for each of the following three projects. On the basis of these calculations, which project is best?

|

|

|

|

|

Note, figures in brackets indicate an investment. For example, the total investment for project A is £70,000.

|

|

|

Question 2

|

|

|

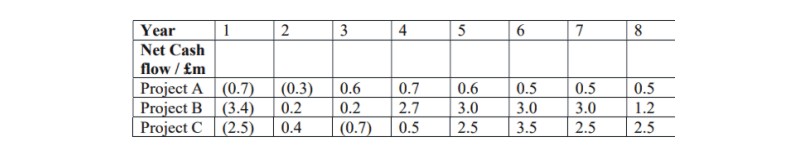

Calculate the Accounting Rate of Return for each of the following three projects. On the basis of these calculations, which project is best?

|

|

|

|

Solutions |

|

Question 1

|

|

|

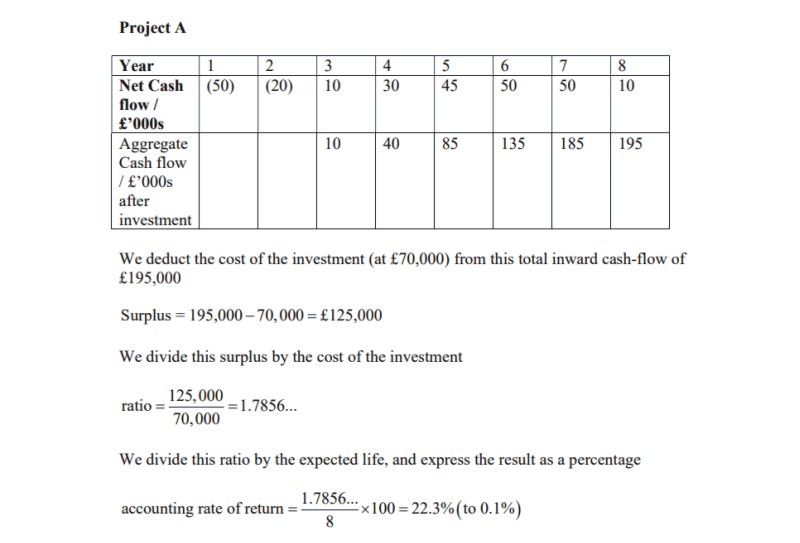

Project A

|

|

|

|

|

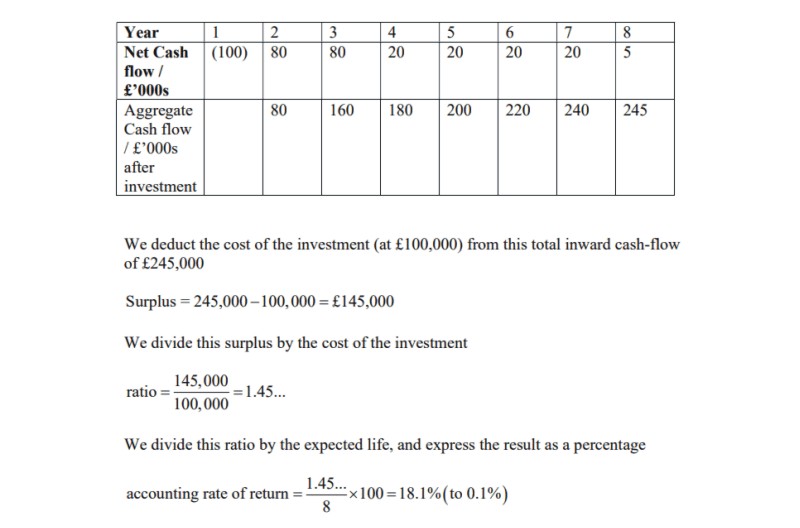

Project B

|

|

|

|

|

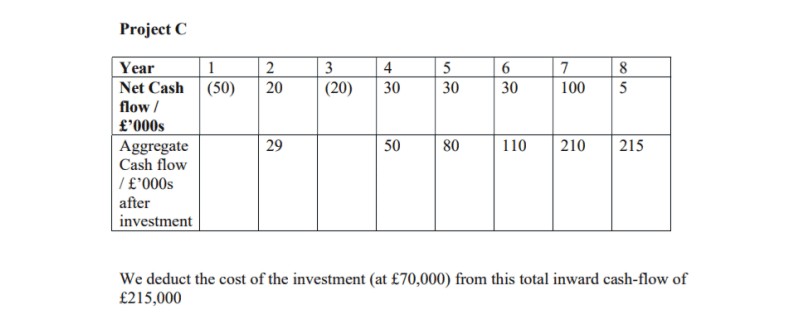

Project C

|

|

|

|

|

|

Question 2

|

|

|

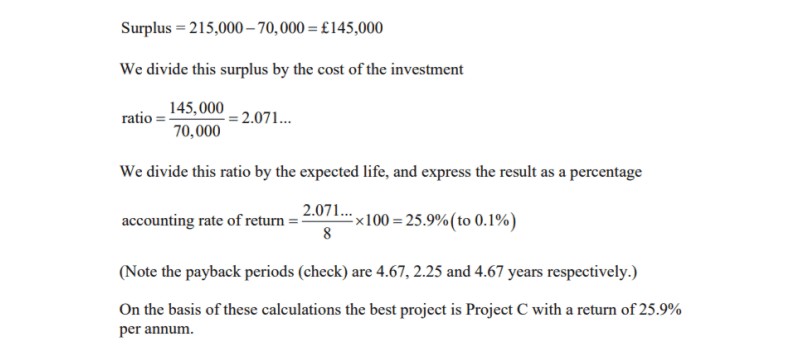

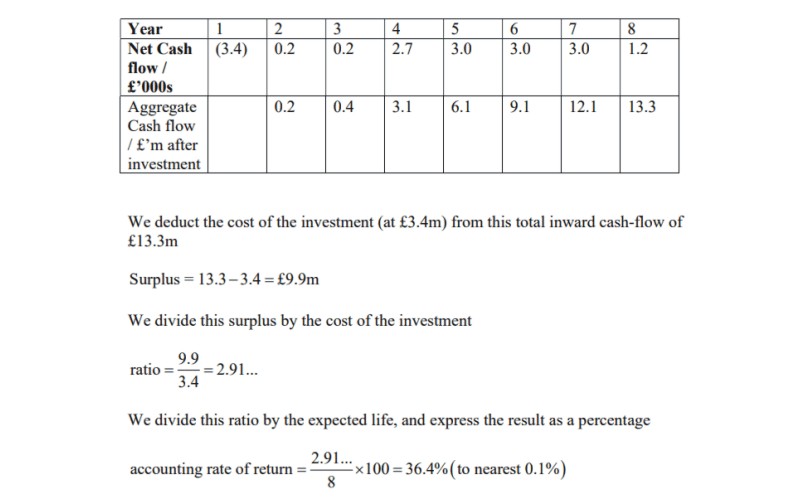

Project A

|

|

|

|

|

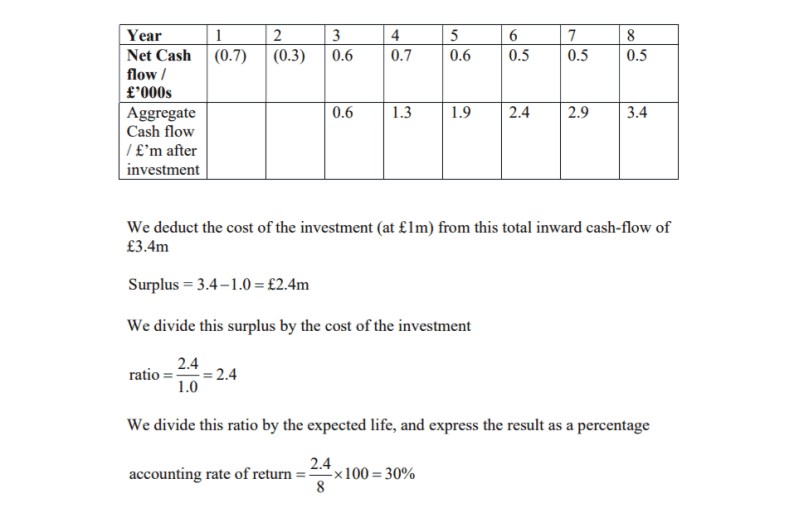

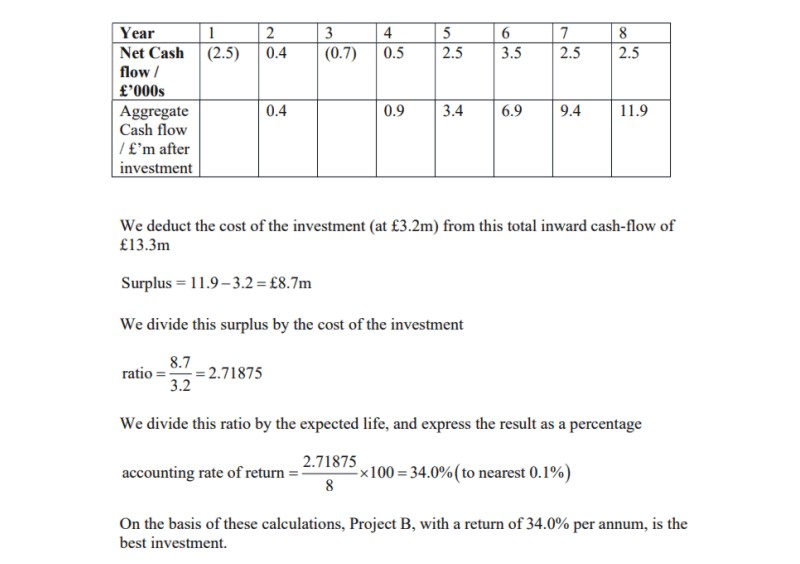

Project B

|

|

|

|

|

|

|

|

Project C

|

|

|

|