|

Investment Appraisal: The Payback Method |

Investment Appraisal |

|

The purpose of investment appraisal is to determine which of a number of investment opportunities is the best. Generally investment involves the commitment of capital which will only make a return at a later date. There are different methods of investment appraisal which emphasise different criteria by which the decision is to be made.

|

|

| 1 | | The payback method emphasises quick return, but could be biased against long-term projects that are more profitable |

| 2 | | The accounting rate of return looks at cash flow over the lifetime of the project and calculates an average rate of return. It takes into account long term profit but ignores the time-value of money |

| 3 | | Net present value incorporates the time value of money by use of discount tables. |

| 4 | | Internal rate of return is a more sophisticated application of net present value |

|

|

|

All of these methods involve making predictions about future cash flows arising from the investment and inevitably involve subjective judgments regarding the future.

|

|

Payback Method |

|

The payback method finds the period of time it takes for the investment to be covered by the return.

|

|

|

We learn the payback method by means of worked examples.

|

|

Exercise in the Payback Method |

|

Question 1

|

|

|

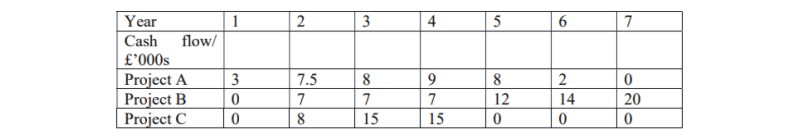

Using only the payback method, which of the following investments, all costing an initial £30,00, would be least profitable?

|

|

|

|

|

What is the disadvantage of the payback method?

|

|

|

Question 2

|

|

|

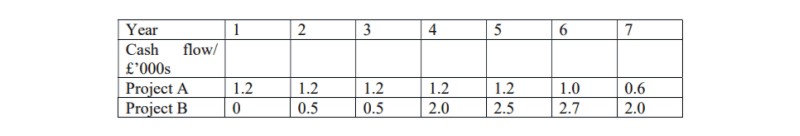

Compare the following two investments by calculating the payback method, and the return at the end of each year.

|

|

|

Investment A costs £3.5m, and investment B costs £4.6m. For investment B a further investment of £0.5m is required at the end of the third year.

|

|

|

|

Solutions |

|

Question 1

|

|

|

|

|

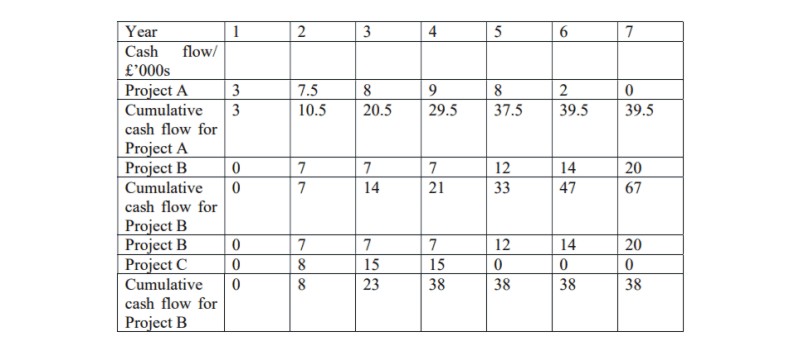

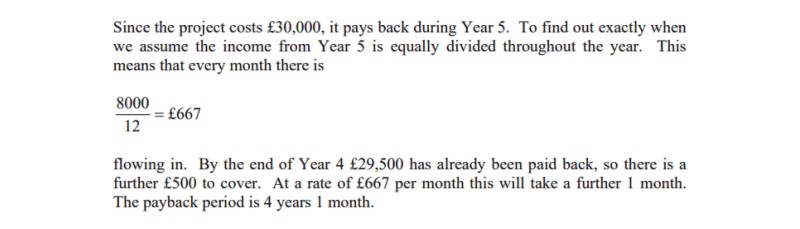

For Project A

|

|

|

|

|

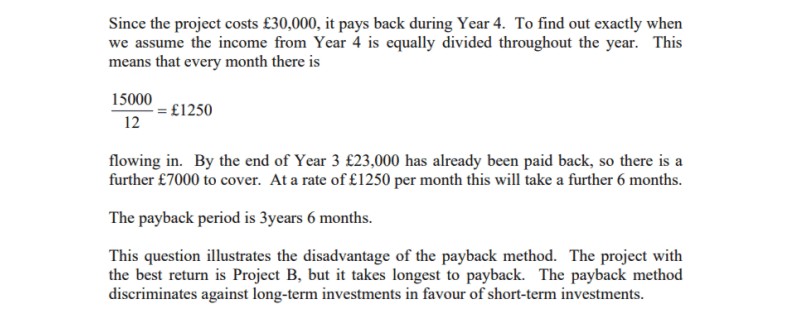

For Project B

|

|

|

|

|

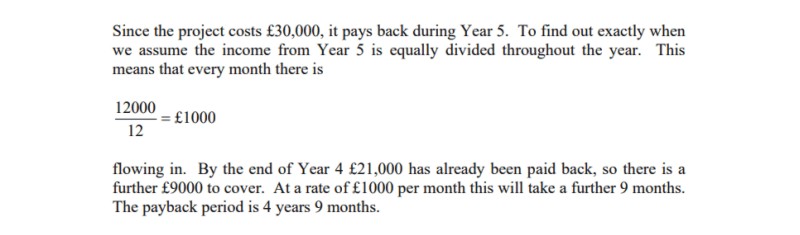

For Project C

|

|

|

|

|

Question 2

|

|

|

|

|

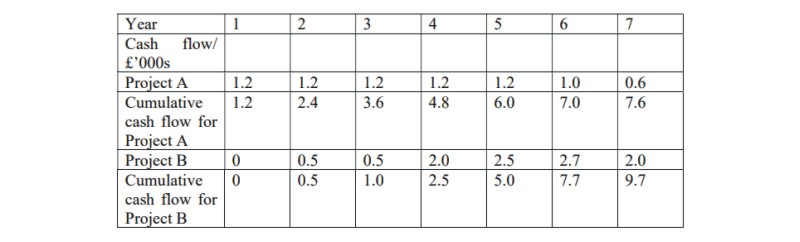

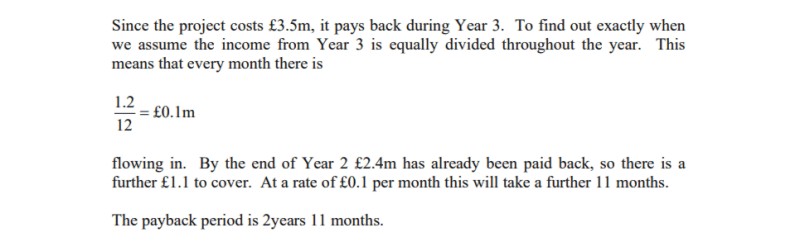

For Project A

|

|

|

|

|

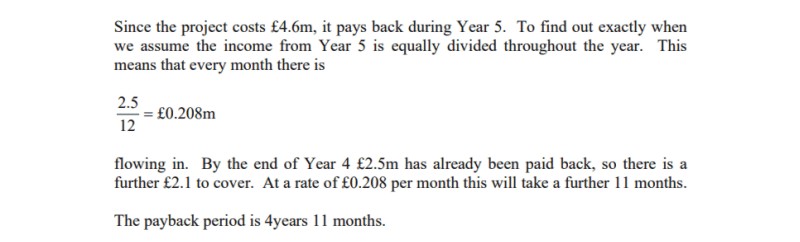

For Project B

|

|

|

|