|

Internal Rate of Return |

Internal Rate of Return |

|

The internal rate of return is the determination by a graphical method for a given investment of the discount rate which produces a net present value of zero.

|

|

|

This is best illustrated by example.

|

|

|

Example

|

|

|

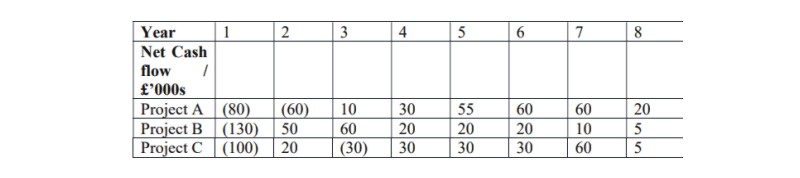

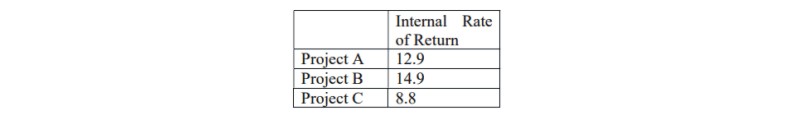

Calculate the Internal Rate of Return for each of the following three projects. On the basis of these calculations, which project is best?

|

|

|

|

|

Solution

|

|

|

For each project we need to calculate the Net Present Value at two different discount rates, preferably one that gives a positive value for the Net Present Value, and one that gives a negative value.

|

|

|

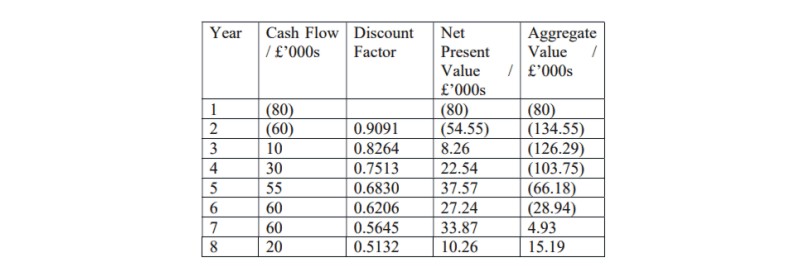

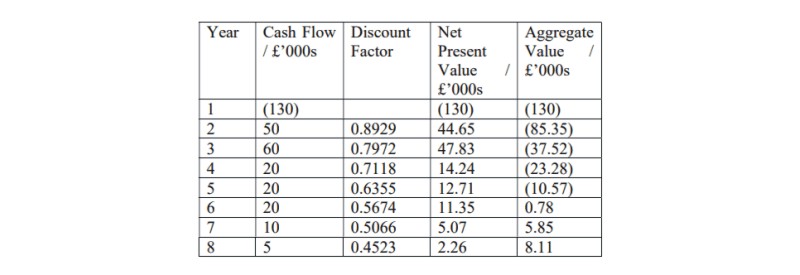

For Project A we will calculate the Net Present Value at discount rates of 10% and at 14%, as follows.

|

|

|

Project A at a discount rate of 10%

|

|

|

|

|

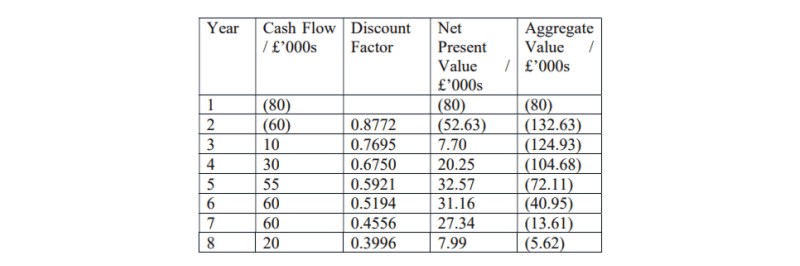

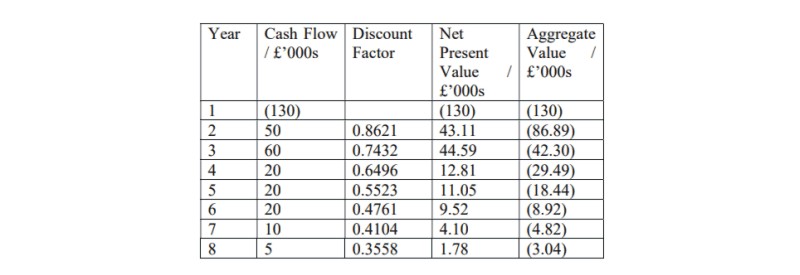

Project A at a discount rate of 14%

|

|

|

|

|

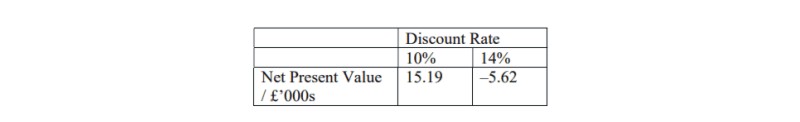

This gives us two values of the Net Present Value, at two different discount rates

|

|

|

|

|

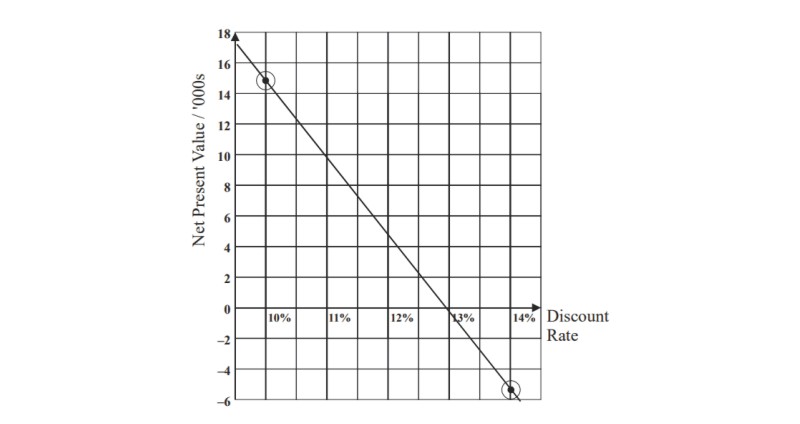

This tells us that the Internal Rate of Return lies between 10% and 14%. To find a more accurate value, we construct a graph of the Rate of Return (horizontal axis) against the Net Present Value (vertical axis). We plot the points

|

|

|

|

on the graph. We draw the line joining these two points. Then the Internal Rate of Return will be that discount rate that gives a Net Present Value of zero — that is, the point where the line crosses the horizontal axis.

|

|

|

|

|

The Internal Rate of Return is 12.9% to the nearest 0.1%.

|

|

|

We now proceed to calculate the discount rate in the same way for the other two investments. We will calculate the net present value of this investment at 12% and 16%.

|

|

|

Project B at a discount rate of 12%

|

|

|

|

|

Project B at a discount rate of 16%

|

|

|

|

|

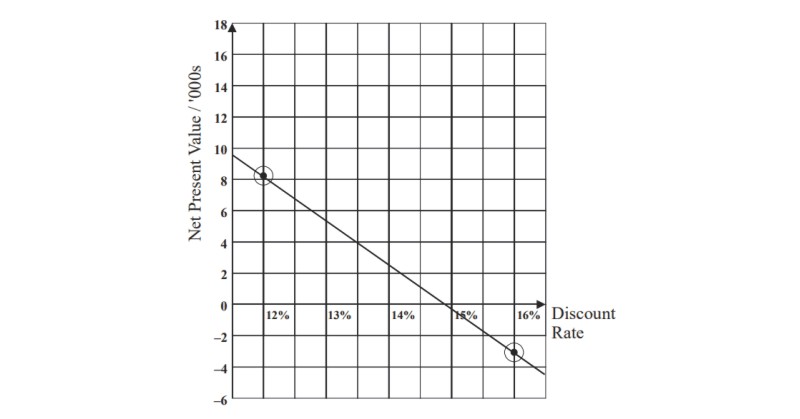

At 12% the net present value is £8,110 and at 16% the net present value is a loss of £3,040. So the internal rate of return lies between 12% and 16%.

|

|

|

By plotting the points on a graph we can determine a more accurate value for the net present value.

|

|

|

|

|

So the Internal Rate of Return is 14.9% to the nearest 0.1%.

|

|

|

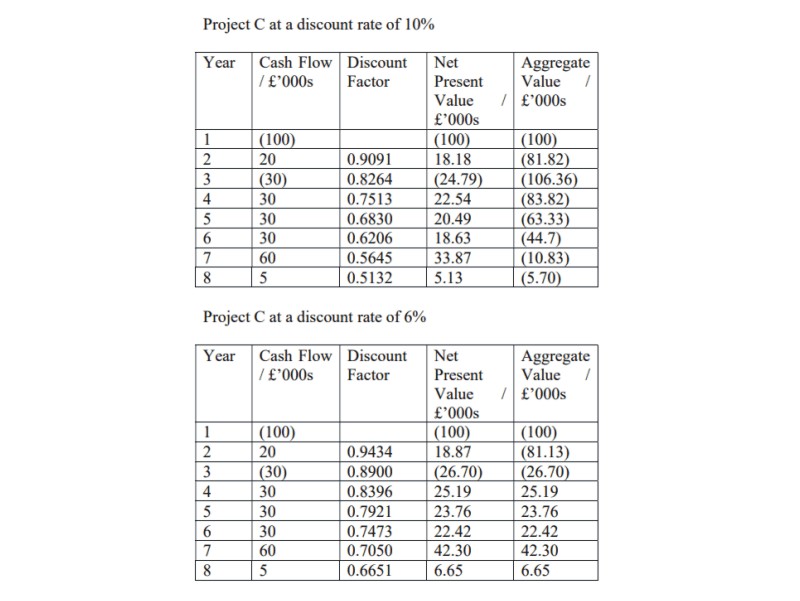

For Project C we will find the net present values at 10% and 6%.

|

|

|

|

|

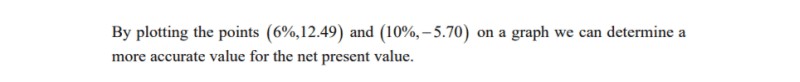

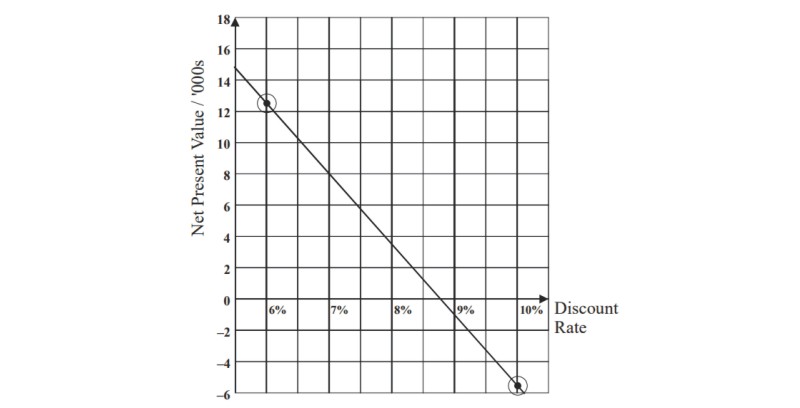

At 6% the net present value is £12,490 and at 10% the net present value is a loss of £5,700. So the internal rate of return lies between 6% and 10%.

|

|

|

|

|

|

In summary

|

|

|

|

|

On the basis of these calculations, the best investment is Project B.

|

|