|

Net Asset Value |

Analysis of Value

|

|

When a company is closed down and its assets are sold, this is called liquidation.

|

|

|

If a company was to go into liquidation, investors would like to know whether the company's assets would be worth anything, and if so, how much of these net assets would attach to each share.

|

|

|

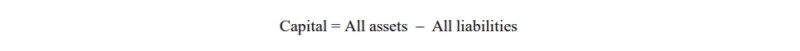

The first piece of information can be read directly from the balance sheet, and requires no further analysis.

|

|

|

|

|

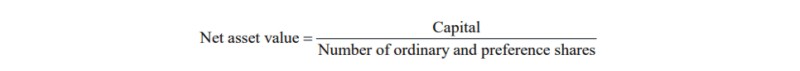

This figure tells the investors what their investment is worth. To find the value per share, simply divide by the number of shares

|

|

|

|

|

To answer the question: what do you get in the event of liquidation? — multiply the net asset value by the number of shares you own.

|

|

|

But there is one proviso: this assumes that the liquidation value of the company would be equal to the book value. This is not always the case. The break-up value of a company is usually less than its value as a going-concern.

|

|

|

But the opposite can happen too. Sometimes a company has a lot of property that has not been properly valued. The property is worth more than the balance sheet says it is. This makes the company vulnerable to asset breakers. An asset breaker is an kind of investor who looks for companies that would be worth more if broken up and sold off in little pieces than if taken as a whole. They make their profit by selling the little pieces for more than the bought the company as a whole.

|

|