|

Excess Supply & Excess Capacity |

Excess supply |

|

Excess supply occurs when, at a given time, the equilibrium price of the market is less than the price that the goods are supplied at. However, excess supply cannot be maintained when a free market operates. The price must be reduced to the equilibrium price, at which time, there is no longer excess supply.

|

|

|

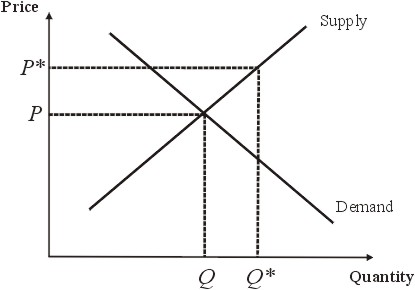

The following graph illustrates excess supply.

|

|

|

|

|

Excess Supply. Suppliers of a good are expecting a price at the market of P* and bring to the market Q* quantity of goods. However, demand is such that the equilibrium price is actually on P and the equilibrium quantity is Q. A temporary situation of excess supply exists.

|

|

|

Let us give an example. Suppliers of bananas are expecting bananas to sell at a price of $1 per pound at the market. They bring 10 tonnes of bananas to sell. In fact, the equilibrium price is only 80p per kilo. The suppliers of the bananas cannot sell all their bananas at this price. One of the suppliers decides to reduce his price to 80c. Thereafter, all the other suppliers of bananas have to follow suit. The market price falls to 80p per kilo. At this price, some of the suppliers of bananas decide to withdraw some of the bananas from the market and make banana paste out of them instead! So the quantity supplied to the market also falls.

|

|

Excess Capacity |

|

Firstly, let us revise the concepts of normal and supernormal profits. Normal profit is the rate of return required to keep an investor's money in a business. It varies from business to business as different businesses involve different levels of risk. When the risk is high, the return to the investors for placing their money with the business must also be high. Investors have the option of putting their money into the bank, or investing it in government bonds. The interest rate the government pays on investments is called the “base rate”. Any rate of interest, over and above the base rate can be called a “premium”. The rate of interest over and above the base rate that an investor must receive in order to invest in a possibly risky business is called the “risk premium”. So, normal profit is the base rate + the risk premium.

|

|

|

Supernormal profit is any profit over and above normal profit. Capitalists wish to find businesses that provide supernormal profits.

|

|

|

There is excess capacity when companies cannot make normal profits.

|

|

|

Excess capacity might arise as a result of excess supply. Let us consider an example of a situation where there is excess supply. Suppliers of bananas are expecting bananas to sell at a price of $1 per kilo at the market. They bring 10 tonnes of bananas to sell. In fact, the equilibrium price is only 80¢ per kilo. The suppliers of the bananas cannot sell all their bananas at this price. One of the suppliers decides to reduce his price to 80¢. Thereafter, all the other suppliers of bananas have to follow suit. The market price falls to 80¢ per kilo. At this price, some of the suppliers of bananas decide to withdraw some of the bananas from the market and make banana paste out of them instead! So the quantity supplied to the market also falls.

|

|

|

Now we can continue the story to illustrate the idea of excess capacity: Owing to the fall in price, some of the producers of bananas were forced to sell their bananas at a price that was less than the price than it cost them to grow the bananas in the first place. They are literally taking a loss growing the bananas. This is called a “profits squeeze”.

|

|

|

In this situation there is excess capacity. Excess capacity is followed by a reduction in capacity: There was a tragic consequence to the story of the banana market. Some of the farmers could not pay their bills. Their creditors took them to court and they were forced to sell their farms. The people who bought the farms turned them into theme parks. The farmers lost all their money and their property and they and their families were plunged into poverty.

|

|

|

Excess capacity is a situation where companies cannot make normal profits; in fact, they may be making losses. Excess capacity is followed (in the long run at least) by a reduction in supply, since either some firms go out of business, or all firms reduce output. Car manufacturing is an example of an industry where there is a tendency towards excess capacity.

|

|