|

Market failure and government intervention |

Correction of market failure arising from externalities |

|

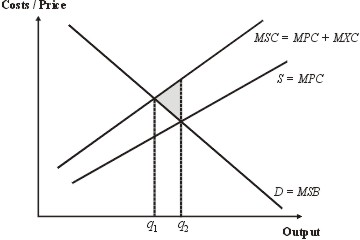

Let us consider the case where a private firm is polluting the environment. This pollution is an example of a social cost. The result is over-production. There is a loss of social benefit. This is called the deadweight loss.

|

|

|

|

|

Deadweight loss

|

|

|

Note here, MPC = Marginal private cost (also equal to the industry supply curve)

MXC = Marginal external cost − the cost of the pollution in this example

MSC = Marginal social cost = MPC + MXC

MSB = Marginal social benefit (also equal to the industry demand schedule)

|

|

|

The deadweight loss is defined to be the total excess of social cost over social benefit arising from over-production. It is represented graphically by the shaded triangle in the diagram above.

|

|

|

The deadweight loss is an example of market failure — in this case, the market fails to provide the allocatively efficient output because the external costs (and benefits) of the good are not “seen” by the producer.

|

|

|

To correct the market failure resulting from over-production, governments aim to pass the cost of over-production onto the firms that produce it. This internalises the externalities, and means that all the costs are borne by the producer. It is the principle that the “polluter pays”. Governments can either

|

|

| (1) | | Impose regulatory controls, that is legal requirements to comply with physical standards. |

| (2) | | Tax polluters |

| (3) | | Impose tradable pollution permits. |

|

|

|

Methods (2) and (3) are known as “market methods”, since they use the market to correct the market failure. Most economists prefer market methods to ensure that the quantity produced is allocatively efficient.

|

|

|

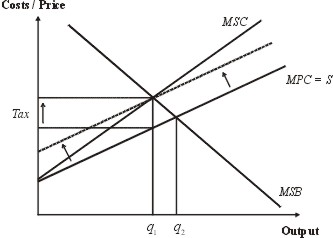

When a tax is imposed it is aimed to set the tax at the level that raises prices so that the quantity produced is reduced to the optimum amount.

|

|

|

|

|

Use of taxation to correct market failure

|

|

|

The dotted line represents the supply curve after the imposition of a tax. The result is that output is reduced from q2 to q1 and the deadweight loss is eliminated.

|

|

|

However, the policy of imposing taxes only works if external costs can be accurately calculated, and if there are further changes in demand, the tax does not automatically respond to the change, resulting in a further market failure developing.

|

|

|

For this reason, the use of tradable pollution permits is now advocated as a means of passing the cost of pollution on to the producers in a way that can adjust to market conditions. Where there are social benefits that outweigh the social costs, then the government may intervene to correct the market failure by (1) State provision, (2) Providing subsidies, or (3) Providing information.

|

|

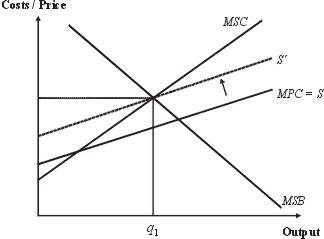

Tradable pollution permits |

|

The American 1990 Clean Air Act required America’s coal-burning power stations to halve by 2000 their emissions of sulphur dioxide which results in acid rain. However, it was anticipated that some companies would succeed in reducing sulphur emissions below the figure of 50%. Because of this the act also permits those companies who more than halve their emissions to sell the right to pollute to other companies that do not succeed in halving their emissions. These permissions to pollute are called “tradable pollution allowances”.

|

|

|

Thus a market in pollution allowances is created. The price of the pollution allowances will be determined in the usual way by supply and demand. The supply of pollution allowances derives from those companies that over-comply with the regulations and more than halve their emissions; and the demand for pollution allowances derives from those companies that do not comply with the regulations in part or in full. To see how this works, the clean air act effectively imposes an increased cost on the power-generating industry — the cost of installing new equipment to reduce the sulphur emissions. This presumably brings the overall output of energy back to the allocatively efficient level.

|

|

|

|

|

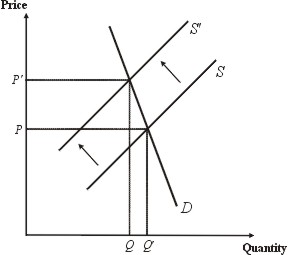

Correction of market failure by use of a pollution permit

|

|

|

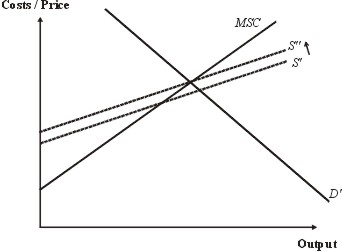

However, a further increase in demand could lead to the creation of further allocative inefficiency, since the graph of the marginal social cost (MSC) is not parallel to the new supply curve (S').

|

|

|

|

|

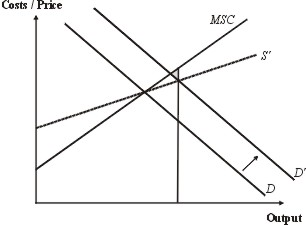

Developing deadweight loss in the context of pollution permits

|

|

|

The shaded area shows a new deadweight loss developing. However, the market in pollution permits should automatically correct this developing market imperfection. The increased demand for power will create increased pressure to pollute. However, the total emissions are capped. Therefore, either the demand for pollution permits will increase or the supply of them will decrease, or, most likely, both. Either way, the price of pollution permits will go up.

|

|

|

|

|

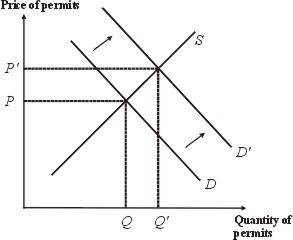

Increasing price of pollution permits

|

|

|

This graph shows how the increased demand for pollution permits forces the price up.

|

|

|

This in turn forces the costs of production of power up, and hence causes a shift to the left in the supply curve back to the optimum, allocatively efficient output level.

|

|

|

|

|

Supply correction

|

|

|

Since the total emissions are capped at the allocatively efficient level for all emissions, the market in pollution permits must correct the potential market failure arising from increasing demand for energy.

|

|

Other market failures |

|

We have examined here the government response to market failure arising from the existence of externalities. There are other sources of market failure.

|

|

|

|

| | (1) | | Where competition is not perfect |

| (2) | | Where there is factor immobility |

| (3) | | Where there are missing markets |

| (4) | | Where there is failure of information |

|

|

|

The response of the government to the existence of imperfect competition is to regulate competition.

|

|

|

There are several kinds of factor immobility. The factor immobility that results in frictional unemployment is corrected by providing further information — that is, job centres where information about available vacancies can be readily seen. The correction of other forms of factor immobility, and especially structural unemployment is a much larger issue.

|

|

|

The missing markets are for pure public and quasi-public goods. The government corrects this kind of market failure by providing the public good itself — for instance, it provides a police force since law and order is a public good for which no private market exists.

|

|

|

The failure of information gives rise to the concept of merit goods, such as health care and education. Again, governments respond to the failure of the market to provide adequate health care and education by providing it themselves.

|

|

Government failure |

|

Viewed from the perspective of markets and the concept of allocative (Pareto) efficiency, the role of government is to correct market failure. We have seen a range of measures that governments adopt in order to achieve this objective — each policy depends on the kind of market failure that the government is seeking to correct. Just as there can be market failure, so there can be government failure. Government failure is a blanket term to apply to any failure of the government to correct a market failure.

|

|

| (1) | | Regarding externalities, we have seen that there are inherent difficulties in any government policy to correct the problems of under or over production. For example, the calculation of the monetary value of an externality is difficult and can become subjective. Additionally, the imposition of a tax in the case of pollution may not result in the market being restored in the long run to its optimum, Pareto efficient position, since over time further externalities can develop to create further losses of social benefits. |

| (2) | | Regarding the problem of imperfect competition, the response of government is to regulate competition. However, there is the danger of “regulatory capture” — that is, when private firms succeed in manipulating the agencies that are supposed to regulate them, and in effect “capture” them, so that these regulatory agencies operate on behalf of the firms and not on behalf of consumers. |

| (3) | | Regarding factor immobility, the existence of structural unemployment is a topic for wider consideration. However, structural problems in an economy can be very deep, and governments may not succeed in correcting them. They may be due to economic forces over which the government has only partial control. |

| (4) | | Regarding the existence of missing markets, governments respond by providing public goods themselves. Likewise, governments correct the lack of information regarding merit goods by providing the correct level of merit goods themselves. However, in both cases government can fail through incompetence or corruption to provide the correct level. |

|

|

|

Governments may also fail through the lack of adequate information, the existence of conflicting objectives and the costs of administration.

|

|

Corruption and public choice theory |

|

When we introduce the concept of “regulatory capture” we have politely introduced the concept of corruption. Still, in this case the corruption occurs on the fringes of government. The government appoints a regulatory body to oversee, for example, a privatised natural monopoly. But the private firm “captures” the regulatory body and manipulates it so that the interests of the private firm are served and not the consumers. This is corruption, and a charge of incompetence or lack of supervision can be levelled against the government because it has allowed the regulatory body to be captured in this way.

|

|

|

However, it is not only the regulatory bodies that can be captured in this way — the whole of government can be captured by private, sectional interests. For example, private firms can succeed in infiltrating a government and causing it to adopt policies that are actually contrary to the public interest as a whole. Likewise, in some countries the government is “captured” by the military, and the result is over-production of military artefacts and “defence”. And so on. In other words, the biggest problem facing any society is the threat of political corruption.

|

|

|

In democracies there exist different parties and periodically the people vote for their government. The political party in power at the time of the election has control over government policy. Public choice theory maintains that such parties in government seek to maintain their power and be re-elected. This can lead to government failure, since in order to be re-elected they may adopt short-term popularist policies that are contrary to the long-term welfare of the people as a whole.

|

|

The Common Agricultural Policy |

|

The European Economic Community (EEC) was formed by the Treaty of Rome in 1958. This created a customs union between the six founder states - Belgium, France, the Federal Republic of Germany, Italy, Luxembourg and the Netherlands. They introduced the Common Agricultural Policy (CAP) apparently to protect farming communities within the customs union. The aims of the Common Agricultural Policy were to (1) increase productivity; (2) raise incomes for farmers; (3) stabilise markets for farm produce; (4) ensure the continuity of supply of farm products; (5) ensure reasonable prices. In order to achieve these aims the EEC introduced a price intervention system. This requires the European Commission to purchase farm products at above the world price. The EEC has now evolved into the European Union (EU) as a result of theTreaty of Maastricht (1991)

|

|

|

The argument in favour of price intervention was as follows: (1) Labour does not readily leave the land. The incomes of farmers and agricultural workers are too low. The government needs to intervene to redistribute wealth to the agricultural sector. (2) Agricultural prices are unstable because price elasticities of demand for agricultural produces are low. This is because demand for food, as it is a necessity, is relatively static and not much influenced by price.

|

|

|

|

|

A change in supply causes a large change in price and only a small change in quantity demanded.

|

|

|

The argument is that action to stabilize prices will improve overall economic efficiency. (3) Intervention to secure a stable food supply is essential for strategic reasons. That is, a country may need a secure supply in the event of war.

|

|

|

The aim of the price support mechanism is to raise farmer's incomes by raising prices.

|

|

|

|

|

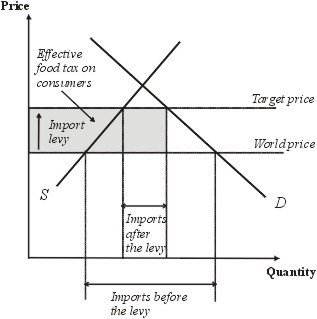

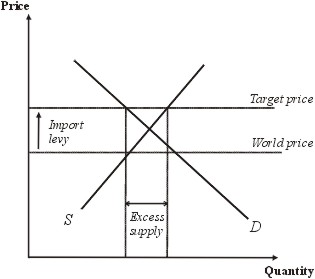

This diagram shows the intended operation of the Common Agricultural Policy. The supply and demand curves shown in the diagram are the supply and demand curves for food products within Europe. Without the imposition of an import levy the supply of agricultural products within Europe would be made up of a small quantity supplied by European farmers and a large level of imports. However, this would necessitate large agricultural unemployment and low farm incomes. To prevent this a levy is imposed. This is intended to be at a level below the market clearing level, so the result is to raise farm incomes within Europe and reduce the size of the imports.

|

|

|

It was expected that the European equilibrium price would lie above the world price. So a target price above the world price is set which reduces the imports and enables European farmers to supply a greater proportion of the demand. Consumers eat less and pay a higher price, so, in effect, they pay an implicit food tax equivalent to the shaded area in the diagram above. So the policy transfers income from food consumers and taxpayers to farmers.

|

|

|

After a period of time this mechanism brought about the unintentional creation of food mountains. This was because the European equilibrium price fell below the target price.

|

|

|

|

|

The problem of excess supply as a result of the Common Agricultural Policy

|

|

|

An intervention system to buy up surpluses when the European equilibrium price fell below the target price was created, because seasonal variations were anticipated. However, technological and other advances meant that intervention became the norm. Thus, butter, beef and cereal mountains among others were created. The surpluses were generally exported, helped by export subsidies. This is equivalent to “dumping” — that is selling abroad at below cost. It disadvantages third world countries. The difference between the world and the internal target price levels is sufficiently high to attract organised crime to exploit it as fraud.

|

|

|

However, the common agricultural policy is also an example of a structural policy. European farming is uncompetitive in worldwide terms because European farms are too small. To increase competitiveness, European farms must become bigger. This would require restructuring of the economy. Farmers would have to move off the land. But agricultural mobility is very low, and high unemployment rates make such restructuring very difficult. Since there are no jobs for ex-farmers to go to, they might as well farm inefficiently as become unemployed.

|

|

|

It can be argued that the Common Agricultural Policy (CAP) is an example of a government failure. It results in a misallocation of resources within the European Union (EU). Additionally, CAP turns Europe, through dumping, into the world's second largest exporter of agricultural products. This makes third world countries poorer, and reduces their ability to import European manufactured goods. High food prices add to European costs and damage international competitiveness.

|

|

|

There have been attempts to reform the Common Agricultural Policy. The McSherry reforms were agreed in 1988. They introduced a quota system designed to stabilize food supplies. The McSherry plan arose as a result of international pressure placed on Europe during the Uruguay round of the GATT trade negotiations. Farmers were also given a voluntary “set aside” system. This is a subsidy paid to farmers to take some of their land out of production. However, this system of reforms failed because (a) the quotas were too generous and (b) the set aside payments were too low.

|

|

|

In 1992 direct income payments were introduced. To receive compensatory payments a farmer had to agree to set aside 15% of his farm's arable are with payments roughly equal to the profit foregone.

|

|

|

It can also be argued that the Common Agricultural Policy failed to achieve its objective of improving farm incomes. Farm incomes are still only 50% of the incomes of non-farming members of society. The relative position of farmers has not been improved. The policy has benefited the larger and wealthier farmers much more than the smaller, poorer farmers. In addition, the financial cost of CAP has been so great that there have been few resources to finance other policies. However, the cost of CAP as a proportion of the European budget is falling. It was 82% in 1971, but 61% in 1992.

|

|