|

Market Conditions |

The Business Environment |

|

The external business environment largely determines the profitability of a business. In our “advanced” Western societies we largely have continuity of supply — that is, there are very rarely shortages of goods; supermarket shelves are stacked with goods, and when one material runs out we replace it by another.

|

|

|

However, the market goes through periods of recession and boom/growth and decline. If you are in a business in structural decline it is hard to make a profit.

|

|

Porter's Five Forces Model |

|

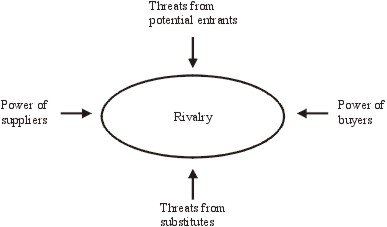

We will use Michael Porter's five forces model in order to illustrate the meaning of market conditions.

|

|

|

Michael Porter identifies five factors or forces that drive competition: (1) existing rivalry between firms; (2) the threat of new entrances to the market; (3) the threat of substitute products and services; (4) the bargaining power of suppliers; (5) the bargaining power of buyers.

|

|

|

He also argues that successful companies possess two kinds of competitive advantage: low cost or differentiation.

|

|

|

Success of the business depends on its environment. One country may have a better infrastructure than another. The “diamond factors” that make one nation more successful than another are: factor conditions (in other words, access to labour, quality of labour, and raw materials), demand conditions, related and supporting industries, company strategy, structure and rivalry. Companies should seek to see to the most sophisticated and demanding buyers who will set a standard for the organization.

The first part of this philosophy demonstrates that the ease with which a company can make a profit depends on the structure of the industry and the nature of its environment. This can be summed up in the following diagram

|

|

|

|

|

Porter's Five Forces

|

|

|

A business will experience great difficulty in making profits if (a) there is intense rivalry within the industry; (b) both suppliers (of labour and raw materials) are powerful; (c) if other companies can easily enter the market, and (d) if there are alternative, substitute products.

|

|

|

Porter analyses each of these factors in turn.

|

|

Competitive rivalry |

|

Factors that increase rivalry

|

|

| 1 | | The more competitors there are and the more equal in size and capability, the more rivalry there is. |

| 2 | | Rivalry increases when demand for the product is only increasing slowly. |

| 3 | | Rivalry increases when competitors use price cuts and other related marketing strategies to boost sales. |

| 4 | | Rivalry increases when products and services are very similar, so consumers experience little loss in switching from one brand to another. |

| 5 | | Rivalry increases when the costs of going out of business are greater than the costs of remaining in business and competing. |

| 6 | | Rivalry becomes unpredictable in its nature when the competitors differ in their strategies, personalities, priorities, resources and national and ethnic origin. |

| 7 | | Rivalry increases when a well funded company from outside the industry acquires a weak firm within it and launches a well-planned campaign to boost sales. |

|

|

Threat of Entry |

|

A barrier to entry is a factor that makes it difficult for a company outside the industry to enter the industry. When there are low barriers to entry, then it is always possible for new firms to enter, and this increases competitiveness within the industry.

|

|

|

The common barriers to entry are

|

|

| 1 | | Economies of scale. When firms become larger they experience lower average costs. It is not easy for a small firm to enter the market. |

| 2 | | The “learning curve”. Success in the industry depends on experience gained from being in the business. It is not easy for a new entrant to replicate this experience. |

| 3 | | Branding. When existing firms in the industry have well-developed brand names, it is not easy for new entrants to win customers from these existing firms. |

| 4 | | Capital. When the capital requirements of entering the industry are very high, only companies with access to sufficient capital can create a new company and compete. |

| 5 | | Cost advantages that do not depend on size. Some companies may have access to advantages that do not depend on economies of scale. For example, they may be closely situated near a raw material. |

| 6 | | Distribution channels. Some companies cannot reach the customer effectively because the existing firms have control over the distribution channels. |

| 7 | | Government policies. Government legislation and policy can create barriers to entry. Governments may create tariff barriers around their country. Patents and copyrights prevent one company from replicating the material of another. |

|

|

Threat of substitutes |

|

A substitute is a product that meets, or nearly meets, the requirements of the product. Each product comprises a series of features that are called the “marketing mix”. For example, the price, colour, function of a product are some aspects of its marketing mix. A perfect substitute is a product with an identical marketing mix. A close substitute is one that has most features of its marketing mix in common with the alternative product. The more substitutes there are to a product, and the closer these substitutes are, then the more competitive the industry will be.

|

|

Power of buyers |

|

Consumers and buyers can have power of choice. When they have power, they can use their bargaining position to bargain away profits from the firms in the industry. Buyers are powerful, for example, when

|

|

| 1 | | There are few buyers and they buy in large quantities. |

| 2 | | When a customer's purchase represents a large proportion of the firm's total sales. |

| 3 | | When the industry is made up of a large number of small firms. |

| 4 | | When the products of the industry are close substitutes to each other, so buyers can switch from one product to another with low costs. |

| 5 | | When the purchase is not essential to the buyer. |

| 6 | | When the buyer has the option to buy from more than one supplier. |

|

|

Power of suppliers |

|

Suppliers provide the resources to the firm to create the product. Suppliers include suppliers of raw materials, energy, labour and manufactured components.

|

|

|

Suppliers are powerful when

|

|

| 1 | | The resources is essential to the firm |

| 2 | | The suppliers are in a secure and comfortable position, and their industry is not rivalrous and intensely competitive. |

| 3 | | When the suppliers provide products or services that are relatively unique, so the firm experiences high costs in switching from one supplier to another. |

|

|

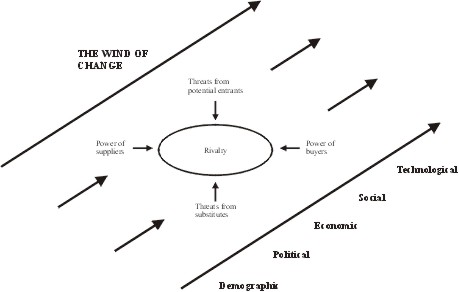

Environmental Trends — the wind of change

|

|

In addition to the forces that affect the immediate external environment of the business, as discussed above, there are also trends in the external environment that will also affect the development of the business over a longer period — these are demographic trends, political trends, economic trends, social trends and technological trends. For example

|

|

|

Demographic trends

What will the impact be of an ageing population? Will skilled labour chose to migrate to Southern Europe?

|

|

|

Political trends

What will a change of government mean for businesses? Will there be increased regulation of business in relation to the environment? Will trade unions become more powerful, and what impact on labour costs and relations will this have? What opportunities are created by the expansion of the European Union?

|

|

|

Social trends

Is there a shortage of skilled labour? Will there be a development of anti-capitalist rioting? What are the implications of the increased preference for working at home? What are the implications of the increasing growth of the leisure industries?

|

|

|

Economic trends

Will Britain join the European currency union? Is the world in global recession? Will there be a decline in armaments expenditure? Will Frankfurt take over as the financial capital of Europe?

|

|

|

Technological trends

Will plastic replace steel in the manufacture of cars? What will be the next developments in computer technology?

|

|

|

|

|

The Wind of Change

|

|

|

|