|

Budgeting and Variance Analysis |

Budgets |

|

A budget is a term for any projection and plan regarding the future of the company. To “budget for” means to plan for the future, to set constraints and to predict. Expenditure is the most obvious thing to budget for, especially since every company must be careful with costs. However, sales can also be budgeted for and production.

|

|

|

So budgets are:

|

|

| • | | prepared and agreed in advance |

| • | | cover a specific time period |

| • | | are expressed in either financial terms or real terms (that is, as physical quantities) |

| • | | relate either to the firm as a whole or to a part of it. |

|

|

Variance Analysis |

|

Actual results may differ from the budgetary predictions. When the actual result differs in a way that is favourable, this is called a positive or favourable variance, and when the difference is unfavourable, this is called a negative or adverse variance.

|

|

|

A variance is a deviation from an expected, budgeted value.

|

|

|

The aim of variance analysis is to analyse in detail those elements of cost that are causing an overall deviation from expected performance.

|

|

|

Some factors that may result in variances are:

|

|

| 1 | | Use of materials |

| 2 | | Prices of materials

|

| 3 | | Efficiency of labour

|

| 4 | | Wages

|

| 5 | | Use of overheads

|

|

|

|

Example — Crockery Limited

|

|

|

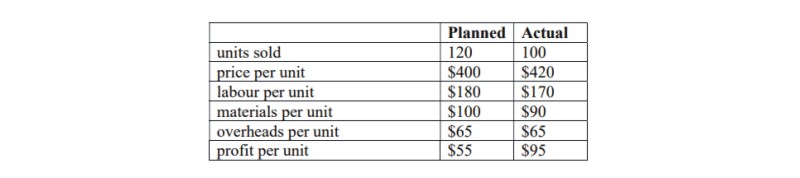

Crockery limited produces a dinner service that is sold in department stores. A budget is prepared on a monthly basis. For March 2001 the following budget and actual figures were noted.

|

|

|

|

|

Using variances, analyse the performance of Crockery limited for March 2001. What other information would be appropriate before you reached a final evaluation of the position?

|

|

|

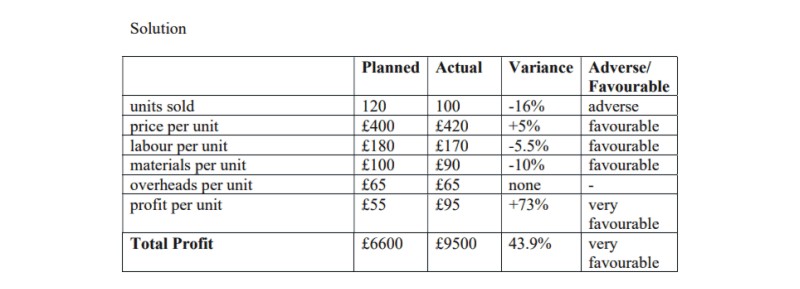

Solution

|

|

|

|

|

Despite the adverse variance in the number of units sold, there have been positive variances in terms of the price and reduction of costs, leading to a substantial positive variance in profit per unit and the total profit.

|

|

|

It may be that an increase in price brought about an increase in revenue, and that the price was not originally set at the optimum level. However, this information is not given in the question, so this is certainly information that would be required before a conclusion was reached. Further information needed would include more details regarding how the reduction in costs was achieved.

|

|

|

The variation from the budget is generally positive, but this suggests some error in forecasting, and very favourable variances can be worrying because they introduce uncertainty into the whole process. The aim of budgeting is to gain greater control over the business so large positive variances can be indications that control is being lost.

|

|

|

Looking in detail at the information, we also need to know how the overheads are being apportioned. If the overheads are based on, for example, the amount of space being used in the factory, then the figure of $65 that is retained in the column for the actual results may be wrong, and may need to be revised upwards, thus eroding the apparently successful variance in profit. This is another reason why variances should be controlled, since calculations of overheads may go wrong as a result.

|

|

Cost centres, revenue centres, profit centres |

|

A cost centre is a department within a firm where costs arise, and can be calculated. A revenue centre is a department within a firm where sales are made. A profit centre is both a revenue centre and a cost centre, hence profits, which are revenue less costs, can be calculated for a profit centre.

|

|

Budgets and Management Accounting |

|

Companies keep financial accounts as a record of the overall profit and loss of the company and as a record of all their assets and liabilities. However, in order to control the business they keep separate management accounts relating to every separate cost, revenue or profit centre in the business.

|

|

|

As an introduction to management accounting, the student should simply be aware that separate cost, revenue and profit centres within the company will have control over their own devolved budgets. In other words, if it is a cost centre, the centre will have control over its budget and the right to spend its budget. The power to control a budget lies at the centre of devolved management.

|

|

Types of budget |

|

The master budget is a prediction of the profit and loss account and balance sheet that is anticipated over some future period.

|

|

|

People who are responsible for spending money within a firm, and in the light of a budget, are called budget holders.

|

|

|

The aim of a budget is to control and evaluate performance, so budgets are used for budgetary control. |

|

|

A production budget is a plan for the physical output of a firm, for example, expected output of cars in a car manufacturing plant. This budget of physical output can be translated into money terms by costing the various aspects of the production budget. When this is done it is called a production cost budget.

|

|

|

When a budget is used to create a limit on spending, then it is called an appropriation budget.

|

|

|

The creditor's budget is a forecast of the firm's credit purchases over time, and the debtor's budget is a forecast of the firm's debtors over time.

|

|

|

The cash budget is also called the cash flow forecast.

|

|

|

A flexible budget is a budget that takes into account the possibility of different levels of activity. This is opposed to a fixed budget which is a prediction of, for example, costs, regardless of the level of output.

|

|

|

Every year budgets have to be adjusted in order to take into account the new conditions for the following year, for example, owing to inflation. One approach is incremental budgeting in which each year a percentage is added onto each budget, possibly in line with inflation. An alternative is zero-based budgeting which means that there is a critical analysis of each budget before anything is added — in other words, there is no simple assumption that each budget has to increase proportionately.

|

|