|

Depreciation by the fixed-rate method |

Wear and tear |

|

Costs is the accounting term for the sums of money required to purchase materials to make a product and pay wages to the people who assemble it, and for any other item or service required in the immediate production of a good or service.

|

|

|

Investment is concerned with buying plant, machinery or assets that are not consumed in the immediate process of producing a good. Investment in plant and machinery is not regarded as a cost. However, plant and machinery wears out, and has to be replaced, and this wear and tear is regarded as a cost. A provision for wear and tear is made and this is called depreciation.

|

|

|

This idea stems from practical need and from our notions of fairness.

|

|

|

If a machine will wear out, and has to be replaced, it is practical to regard the replacement as a cost of production, and to record it as such in the accounts.

|

|

|

When one makes an investment in the first place, the company or individual who makes this investment is hoping to reap the benefit of higher profits or income at a later stage. So this is a risk undertaken for future gain. It is not regarded as a deduction from income, even though society as a whole should benefit from this decision.

|

|

|

On the other hand, once the investment has been made, it seems fair to say that the running down of the value of the investment is a cost, and society does allow it to be deductible for tax purposes — in other words, it is regarded as a cost. This is partly a decision based on practicalities also. If society did not regard wear and tear as a cost, then there would be very little investment. The cost of investment and the risk involved would be too high, and investment would be discouraged, to the ruin of all!

|

|

|

Purchase of property is clearly an investment. However, property does not tend to depreciate. On the contrary, it tends to appreciate in value over time. Therefore, the tax authorities does not grant capital allowances on property. On the contrary, it takes a cut of the profits created by the appreciation of property by charging stamp duty on the sale of property.

|

|

|

Questions

|

|

|

1. Why is investment not regarded as a cost?

|

|

|

Investment is undertaken in the hope of profits. Once the investment has been made it is necessary to purchase raw materials and labour to produce goods and services. These are costs of producing the goods and services, but the investment is not a cost in this sense.

|

|

|

2. Why is depreciation regarded as a cost?

|

|

|

The wear and tear on a machine (for example) means that the machine must be replaced at some stage. So this is a cost of the production process.

|

|

Calculating Depreciation |

|

The fixed assets are the assets that the company intends to use rather than sell. Tangible fixed assets are contrasted with liquid assets, which are the assets tied up in the working of the company, such as stocks that are consumed and converted into finished products.

|

|

|

But tangible fixed assets also tend to be consumed, though in a different way. Fixed assets wear out over a longer period of time, and this wear and tear is known as depreciation.

|

|

|

In the company accounts depreciation is subtracted from the original cost of the item. The original cost of the item appears in the company accounts until such time as it is disposed of. The depreciation, which is its loss of value, is accumulated from year to year.

|

|

|

Depreciation can be calculated in various ways, and the company accounts should indicate how this is done.

|

|

|

Companies have to decide how accurately to compute depreciation.

|

|

|

Other things being equal, a wholly accurate calculation of the depreciation of assets is desirable as it provides the most information. But information costs money, and companies usually settle for a rougher estimate of the depreciation.

|

|

|

Companies group together various kinds of asset and determine a policy for each, rather than record the actual value of each separate item.

|

|

|

The two principal methods for the calculation of depreciation are:

|

|

| (1) | | The fixed rate method — also called straight line depreciation |

| (2) | | The reducing balance method — compound rate of depreciation |

|

|

Fixed Rate Method |

|

This is also called depreciation by the straight line method.

|

|

|

The fixed rate method simply settles upon a fixed rate of depreciation, and applies that to the item, until the item has no value.

|

|

|

Since assets are usually sold off before they reach zero value, the fixed rate of interest is usually calculated by subtracting this expected residual value — that is, the value of the item at the time it is sold. The examples will make this clearer.

|

|

|

|

|

It is best to demonstrate this method by worked examples.

|

|

|

Exercise

|

|

|

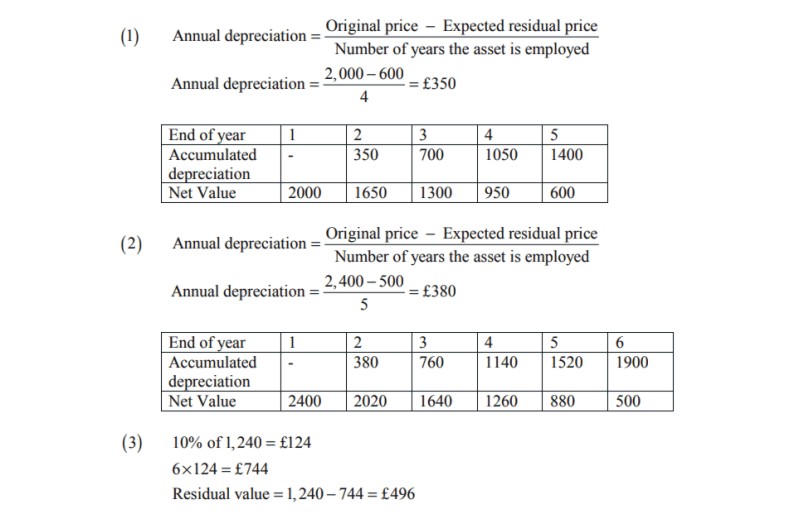

1. The purchase price of a personal computer is £2,000 and its resale value at the end of 4 years is £600. Calculate its annual depreciation using the fixed rate method. What is its value at the end of each of the four years?

|

|

|

2. A photocopier costs £2,400 new. After five years the company that supplied it will offer a discount of £500 on a new machine for the parts. What is the annual rate of depreciation by the fixed rate method, and what is its value at the end of each year?

|

|

|

3. The beautiful ebony table in the boss's office originally cost £1,240. It is expected to depreciate at a fixed rate of 10% . What will be its residual value at the end of six years?

|

|

|

Solutions

|

|

|

|