|

Stock Evaluation

|

Valuing Stock |

|

There are two methods of valuing stock

|

|

| (1) | | First in first out (FIFO) |

| (2) | | Last in first out (LIFO) |

|

|

|

To explain the difference between the two: Imagine a stack of plates. Additional plates are constantly being added to the stack from the top.

|

|

|

In the first in first out (FIFO) principle, plates are being removed from the bottom of the stack, to the oldest plates in the stack are used first. In the last in first out (LIFO) principle, the plates are removed from the top.

|

|

|

If the value of the plates was always the same, both methods of evaluating stock would result in the same calculation of the value of the plates. However, consider the case where the price of plates is rising.

|

|

|

In this instance, the first in first out principle, the oldest plates are removed first, so the value of the stock is the value of the latest items. In the last in first out principle, the stock is value at the price of the oldest items and the next oldest items and so forth.

|

|

|

Thus, the first in first out principle gives a higher value to the stock, if prices are rising generally (and a lower value if they are falling).

|

|

|

On the whole it might seem appropriate to use the first in first out principle, especially as most companies are likely to use old stock first.

|

|

|

However, some companies do use the last in first out principle, because they prefer to have the lower estimate. It is a kind of internal discipline. What it means is that the latest prices of raw materials are passed on to the costs of production. That means that the production profitability is not over-estimated.

|

|

|

The the UK, the Inland Revenue regard the last in first out (LIFO) principle as under-estimating profit, and will not accept it. Companies that use this method need two sets of accounts — one for themselves and one for the Inland Revenue. But this is normal practice anyway, since the Inland Revenue do not accept depreciation as a cost either, but companies have to recognise it as an cost internally. The move to the last in first out (LIFO) method does not, therefore, usually cause much extra complication.

|

|

|

It is best to learn stock evaluation through worked examples.

|

|

Exercise in Stock Evaluation |

|

Brierley's Sports Manufactures Limited

|

|

|

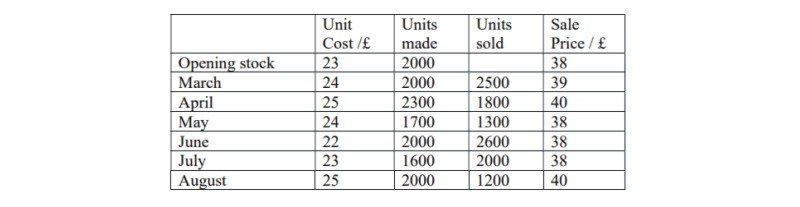

Brierley's Sports Manufactures Limited conducted a stock-taking, and obtained the following information

|

|

|

TRACK SUITS

|

|

|

|

|

Calculate the value of the closing stock of this make of sportswear by (a) FIFO and (b) LIFO.

|

|

|

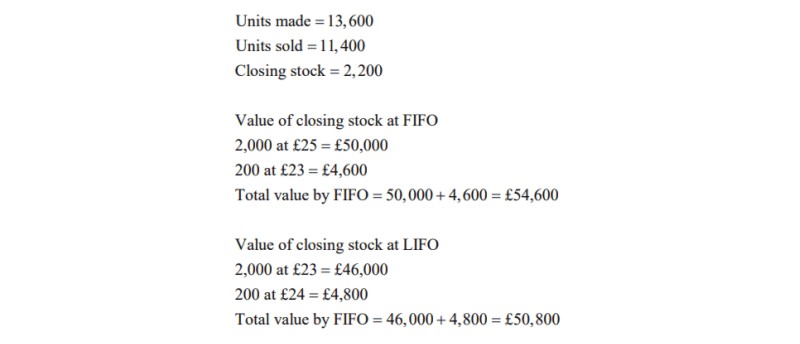

Solution

|

|

|

|

|

Long Johns Limited

|

|

|

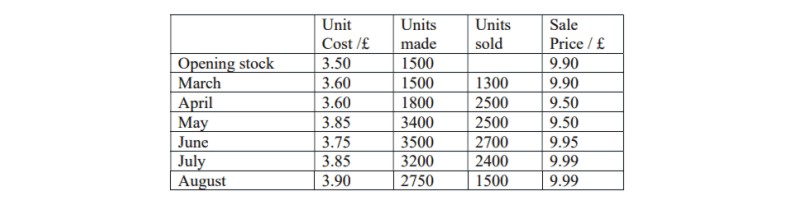

Brierley's Sports Manufactures Limited also manufacture Long Johns. Given the following information, calculate the value of the stock at the end of each month.

|

|

|

LONG JOHNS

|

|

|

|

|

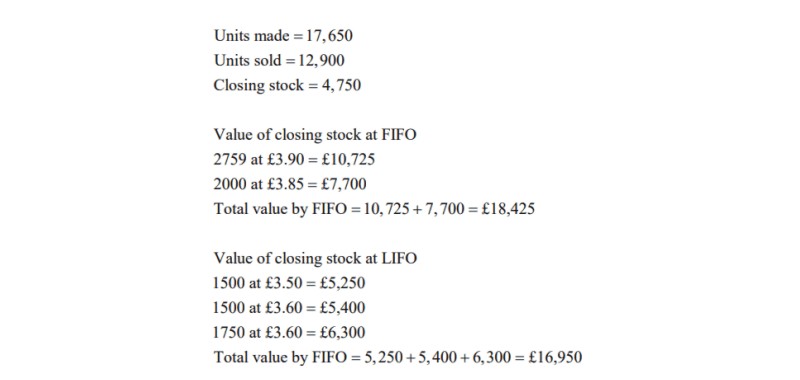

Solution

|

|

|

|