|

Working Capital and Liquidity |

Working capital and Net Current Assets |

|

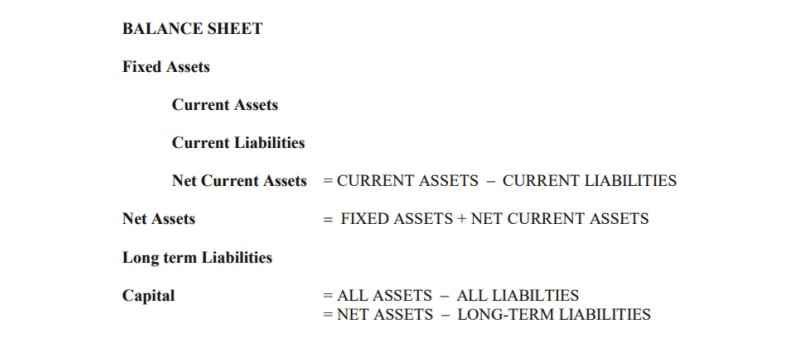

As far as Business Studies is concerned, working capital is another term for the figure that appears in the Balance Sheet as Net Current Assets. (Accountants might see it otherwise.)

|

|

|

|

|

Working capital appears as current assets less current liabilities and is equivalent to the accounting term, Net Current Assets.

|

|

|

We ask a number of questions.

|

|

|

Why is it useful to distinguish between fixed assets and current assets, and between long term liabilities and short term liabilities?

|

|

|

What are the current assets and current liabilities?

|

|

|

Why is working capital called “working” capital?

|

|

|

Why can you not run a business without working capital?

|

|

|

Further Questions

|

|

| 1 | | Define working capital, net assets and capital employed. |

| 2 | | Why is the point that a machine cannot run without oil useful in understanding the operation of working capital in business? |

| 3 | | Why is it possible to run a business without working capital? |

|

|

The working capital time clock |

|

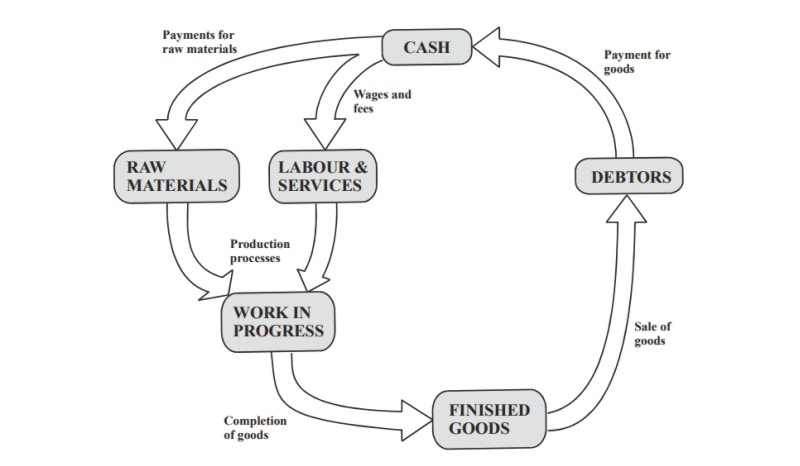

The following diagram represents the movement of capital through a business.

|

|

|

|

|

What does the working capital time clock show us about why working capital exists?

|

|

|

It shows us that working capital exists because of the time taken to produce and sell goods.

|

|

|

The diagram is called the working capital time clock or the working capital cycle.

|

|

|

Why is it desirable to reduce working capital to a minimum?

|

|

|

How can working capital be reduced to a minimum?

|

|

|

Does having a minimum working capital mean that capital is being run-down?

|

|

Liquidity |

|

What might be meant by a breakdown in the working capital cycle, and what could cause such a breakdown?

|

|

|

How can a liquidity crisis be predicted?

|

|

|

Questions

|

|

| 1 | | How does the distinction in the working capital time clock diagram between “reservoirs” and “pipes” help us to analyse the causes of a failure of efficiency? |

| 2 | | Why does the term “liquidity crisis” normally refer to the depletion of cash? In what other ways can the working capital cycle break down? |

| 3 | | Is there any other way of predicting a cash-flow crisis, other than by examining the company accounts? |

| 4 | | Does getting all your working capital to a minimum mean having no working-capital at all? |

| 5 | | Two companies are in direct competition with each other. Company A has an optimum working capital. Company B does not. Company A, however, does have sufficient liquid assets to meet current liabilities. Does Company B have a problem? |

|

|