|

Investment Appraisal: Net Present Value |

The Time Value of Money |

|

Which would you rather have — £100 now or £100 three years later?

|

|

|

Answer — £100 now!

|

|

|

Why would you rather have £100 now than £100 three years later?

|

|

|

Two answers to this: Firstly, if you are going to spend the £100, you would rather spend it now than in three years time. And in three years time the £100 will not be worth as much.

|

|

|

Secondly, if you are going to invest the £100, then you will have the interest on it in three years time to spend as well as the principal.

|

|

You have a choice between two investments:

Project A: Invest £100 now and recoup £200 after two years.

Project B: Invest £100 now and recoup £200 after three years.

|

|

|

Which is better, and why?

|

|

|

Project A is better because you get your profit sooner. An amount of money at a later date is not worth as much as the same amount of money at an earlier date.

|

|

|

This captures the idea that money changes value with time, and is called the time value of money.

|

|

|

|

|

Government Bonds and the Time Value of Money |

|

Government Bonds and Gilts

|

|

|

A bond is a legal document issued by the government in return for the loan of a sum of money. The bond acknowledges the debt and promises to pay a fixed nominal rate of interest on the loan until such time as the bond matures, at which point the sum lent is repaid.

|

|

|

So, bonds have a maturity date and a fixed nominal rate of interest.

|

|

|

A gilt is another name for a government bond. Companies and other institutions can issue bonds, but only government bonds are “gilt—edged” because they are regarded as the safest asset possible.

|

|

|

All gilts are bonds, but not all bonds are gilts.

|

|

|

Why are government bonds “gilt—edged”?

|

|

|

The term gilt—edged indicates the risk—free nature of the government bond. Government bonds are regarded as virtually risk free, because it is expected that the government will certainly be willing to repay any money it borrowed. Of course, this is not absolutely certain, but if the government is not willing, or unable to pay, then this would indicate a complete collapse of the economy, and nothing, in that case, would be risk—free.

|

|

|

Index—linked gilts

|

|

|

The government now issues index—linked gilts which are guaranteed against inflation.

|

|

|

Thus the rate of return on these index—linked gilts represents the premium on the pure—time preference of money — that is, the return that must be given to investors to induce them to defer their spending of money to a later date.

|

|

|

The value of index—linked gilts is thus an indication of the pure—time preference of money.

|

|

|

During 2003 index—linked gilts paid a premium of 2.5%, so we will take the pure time preference of money to be 2.5%.

|

|

|

Inflation premium

|

|

|

Inflation causes money to depreciate in value. Therefore, an inflation premium must be paid to investors to induce them not to spend their money now, and to invest it.

|

|

|

The value of the inflation premium in 2003 is approximately 5.5%.

|

|

|

In 2003 money gilts with a fifteen year maturity date yield 8%. Subtracting 2.5% for the pure time preference of money indicates that investors at that time expected inflation in the UK to average at 5.5% per year for the next fifteen years.

|

|

|

Risk premium

|

|

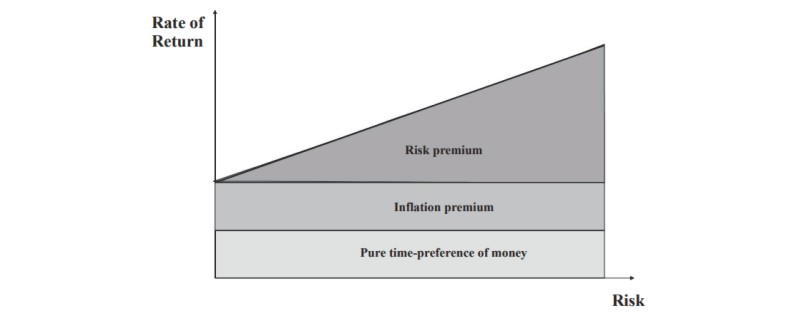

| The idea of risk is not directly measurable. In general as risk increases the rate of return required to induce an investor to accept that risk also increases proportionately.

|

|

|

The term proportionately here means that there is a straight—line relationship between risk and risk premium, accepting, of course, that risk is not really a measurable quantity. However, this enables us to picture the relationship between the rate of return of an investment and risk in graphical terms.

|

|

|

|

|

Questions

|

|

|

1. What is the distinction between a bond and a gilt?

|

|

|

All gilts are bonds, but not all bonds are gilts. A bond is a legal document binding the issuer to pay back (redeem) a debt in a stated period of time. A gilt is a government bond.

|

|

|

2. Why are government bonds safe? Would that be the case in every country?

|

|

|

Government bonds are reasonably safe because the country does not expect a revolution. If a revolution is expected, or a civil war, or invasion or some other kind of catastrophe, such as the end of the world, then government bonds will not be safe. Some countries have unstable political, social and economic climates which makes investment in them more risky.

|

|

|

3. What does the phrase index—linked mean?

|

|

|

|

|

|

Index linked means that the value of the bond or other quantity is linked to inflation. For example, a 2.5% index linked bond will pay a rate or return that is 2.5% above the retail price index. If the retail price index is 4% then the return will be 6.5% in nominal terms.

|

|

|

4. How can we calculate the premium owing to the pure time value of money?

|

|

|

By looking at the yield (rate of interest) payable on government index linked gilts.

|

|

Discounting Methods |

|

In order to take account of the depreciation in the value of money over time (the time value of money), investment analysis use discounting methods.

|

|

|

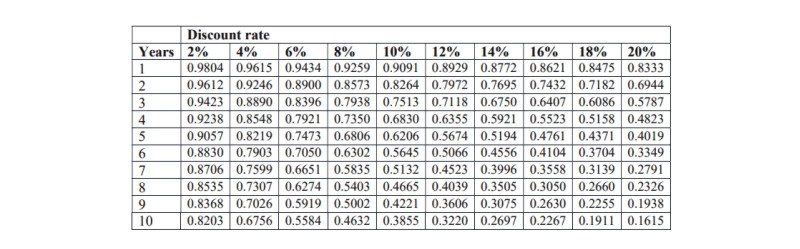

Here is a discount table

|

|

Discount table |

|

|

|

|

|

|

The discount table enables you to calculate the present value of a sum of money a number of years later at a given rate of discount.

|

|

|

Example

|

|

|

Find the net present value of £100 in three years time at a discount rate of 8%. What will be the net present value of £150 in three years time at the same discount rate?

|

|

|

Solution

|

|

|

From the table the discount rate is 0.7938. Therefore, £100 in three years time is worth

|

|

|

|

|

Likewise, £150 in three years time will be worth

|

|

|

|

|

The discounting of money by these methods is used to compare the value of different investment projects.

|

|

|

Example

|

|

|

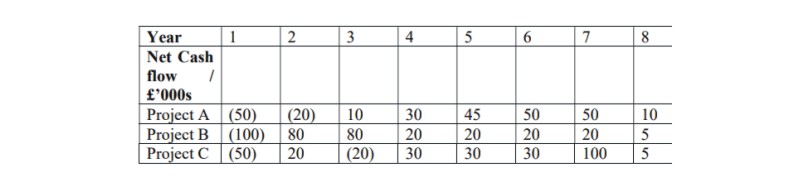

Calculate the Net Present Value for each of the following three projects, using a discount factor of 10%. On the basis of these calculations, which project is best?

|

|

|

|

|

Note, figures in brackets indicate an investment.

|

|

|

Solution

|

|

|

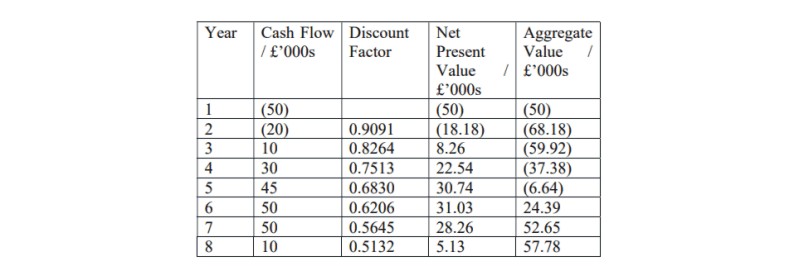

Project A at a discount rate of 10%

|

|

|

|

|

The Net Present Value of the investment is £57,780.

|

|

|

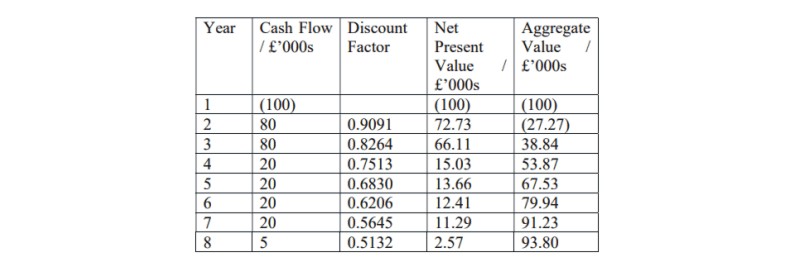

Project B at a discount rate of 10%

|

|

|

|

|

The Net Present Value of the investment is £93,800.

|

|

|

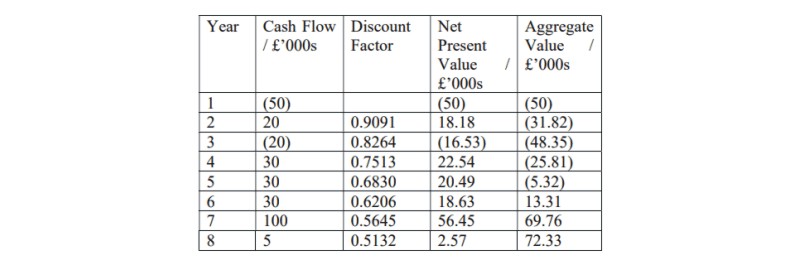

Project Cat a discount rate of 10%

|

|

|

|

|

The Net Present Value of the investment is £72,330.

|

|

|

On the basis of these calculations, Project B is the best investment.

|

|

Comparing the different methods |

|

Which of the three methods — payback, annual rate of return or discounting, is the best?

|

|

|

The short answer is that the discounting method is best. It is a little more complicated and takes longer to calculate. It is also based on assumptions about the appropriate rate of discount. (However, this is not a serious flaw, since that can be overcome by calculating what is called the internal rate of return, the subject of another unit.)

|

|

|

The payback method is relatively quick to calculate, but it is regarded as giving undue emphasis to investments that provide quick returns. In other words, it encourages “short—termism”. However, it is useful to know how quickly an investment “pays back” in purely financial terms.

|

|