|

Gearing and Risk |

Sources of investment capital — equity and non-equity |

|

Companies get their investment capital from different sources:

|

|

| • | | From investors in the form of share capital |

| • | | From directors in the form of personal loans

|

| • | | From banks and other financial institutions in the form of loan capital |

|

|

|

If we take out of these sources of finance the personal loans of the directors, which tend to apply to small companies, then we are left with two major sources of finance

|

|

| • | | Shareholder's funds

These are funds that do not have to be repaid, and have no fixed rate of interest.

|

| • | | Long-term borrowings from financial institutions

These are borrowings with a variable rate of interest |

|

|

|

The proportion of the finance of the company from one or other of these sources makes up the financial strategy of the company.

|

|

|

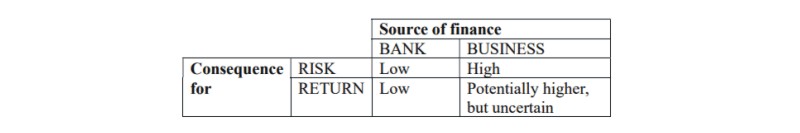

As with all things in business, there are advantages and disadvantages to the two types of capital. Share capital is less risky, but also less profitable for the company; loan capital is more risky, but more profitable. So, as ever, profit is balanced against risk in business.

|

|

|

We shall examine why this is so: long-term borrowings appear in the balance sheet as long-term liabilities. The money borrowed has to be repaid, and the cost of the interest on the borrowing must be deducted from profits. Hence, if the company enters into a difficult period, the fact that these sums must be paid constitutes a risk to the company. By contrast, share capital is never repaid, and a dividend on share capital does not have to be announced. Consequently, share capital is less risky.

|

|

|

But loan capital is expensive. Although a dividend on share capital does not have to be paid, it is desirable to do so, because investors expect a return on their investment. Directors of businesses are ultimately responsible to the shareholders, and although they have considerable power by virtue of their position, they can also be removed at the Annual General Meeting. Shareholders are kept happy by high dividends.

|

|

|

The reason for investing in a business, rather than putting money into a bank, is that the business will pay a higher rate of return. In return for this higher rate, shareholders accept the risk of being in business. So share-capital has to be rewarded, in general, by price/earnings ratios that are above the going rate of interest.

|

|

|

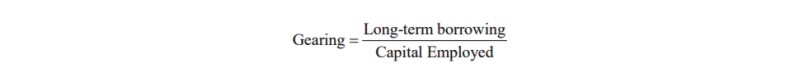

Investors will, therefore, want to know the proportion of capital invested in a company that comes from a bank, or from share-capital. The ratio which provides this information is called gearing.

|

|

|

|

|

Here, long-term borrowings are all long-term liabilities, that is, loans and debentures.

|

|

|

In general, high gearing means high risk, but also, higher profits.

|

|

|

The risk is insolvency — if profits fall below interest rates, the company will soon be insolvent.

|

|

|

When a company increases the proportion of loan-capital employed in the company, this is called gearing-up or leverage.

|

|

|

Questions

|

|

|

1. Why is share capital less risky for the company than borrowing from a bank?

|

|

|

Because, if the going gets tough, you do not have to pay a dividend, but the interest on a bank loan does have to be paid.

|

|

|

2. Why is share capital less profitable for the company than borrowing from a bank?

|

|

|

Interest rates on bank loans are higher than the dividends that have to be paid on share capital. This is because shareholders accept an increase in the value of the company as part of their return on the investment.

|

|

|

Summary

|

|

|

|